Sales of Technical Consumer Goods (TCG) are currently enjoying a surge. At the same time, the market is experiencing rising prices and supply chain challenges. So how are distributors, retailers and resellers responding as they plan for the second half of the year? There are three key aspects you need to focus on: Growth, Prices and Supply Chain. Our webinar Talking Tech: Decoding shortages, high demand and rising prices is your guide to planning ahead.

Growth: Is it real and sustainable?

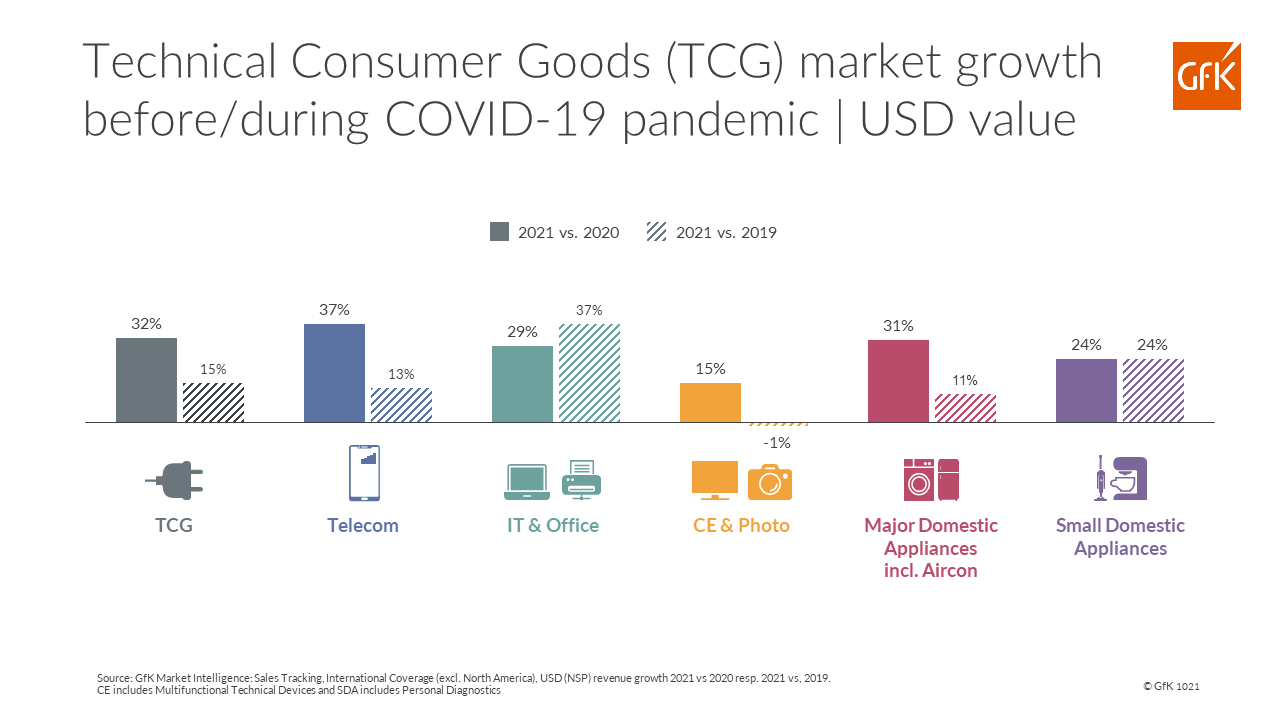

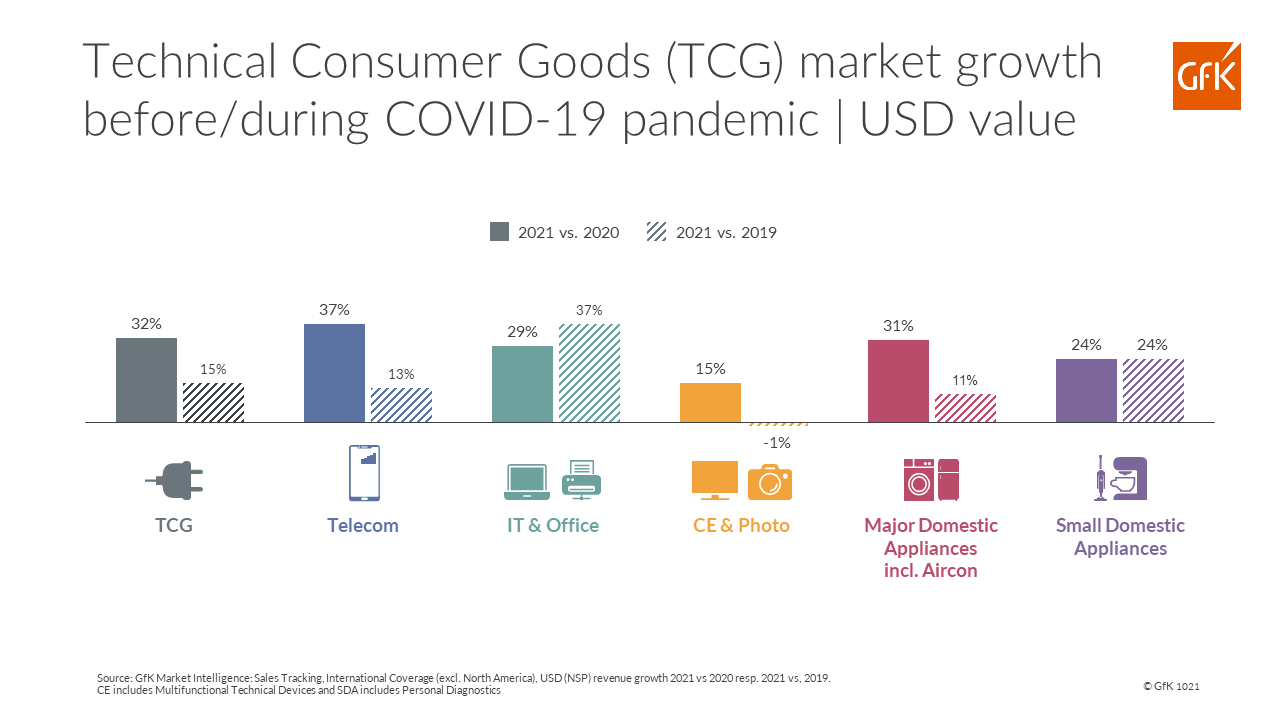

As consumers continued to live, work and entertain at home during the first four months of the year, the need to equip their home as the HQ of every activity remained too. The TCG market has been a major beneficiary of the COVID-19 pandemic lockdown-imposed trend for the home ‘hub’, with sales value up 32.2% year-on-year to April 2021. With all TCG sectors enjoying double-digit growth, the market is now valued at $282 billion. Our clients are asking us questions like, "Is this a real growth, or is it purely pandemic-related and therefore likely to ease post-lockdowns?" Our analysis of sales in 2020 and 2021 versus performance in 2019 reveals that the upticks we are seeing are genuine market growth (see Chart 1).

TCG markets in total experienced a substantial growth of 15% even when compared to before the pandemic in 2019, highlighting the new level of demand reached in 2021. Be sure you understand critical dynamics in time by monitoring sector and country trends.

Chart 1: TCG markets in 2020 and 2021 versus 2019

Prices: Understand and accommodate for price inflation

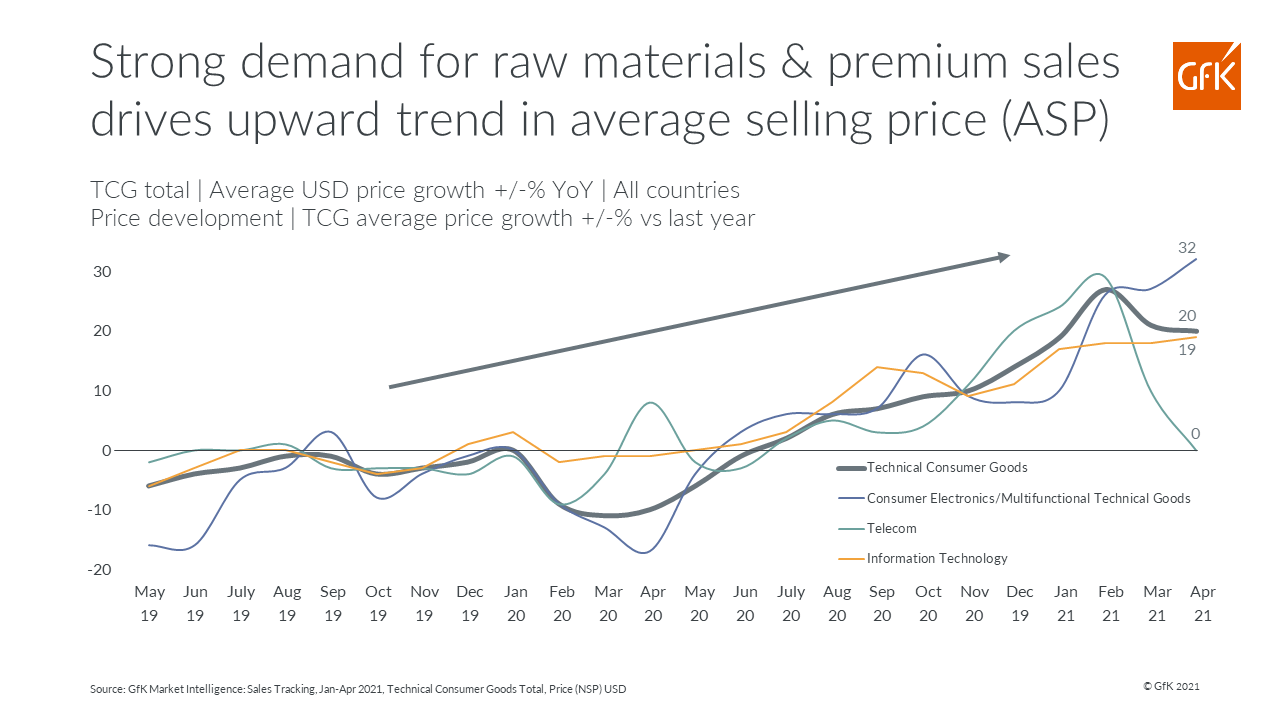

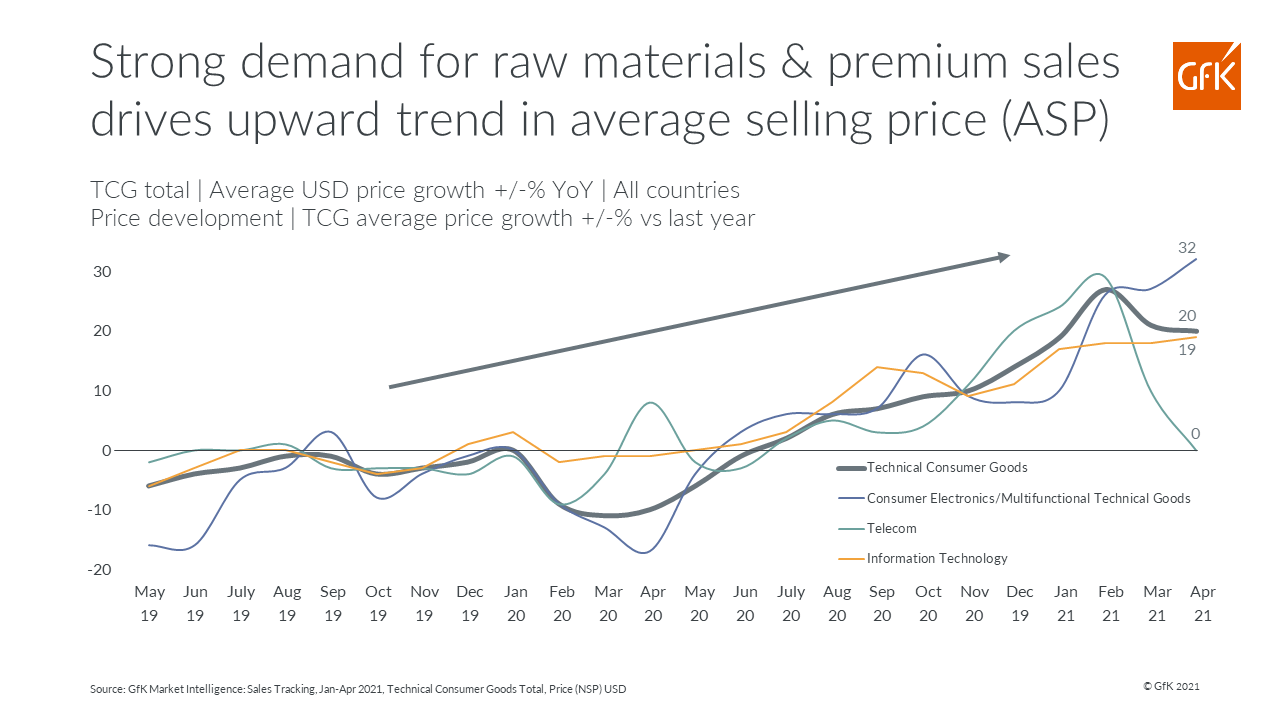

In the first four months of this year, we witnessed a significant upward trend in average retail sales price (ASP) caused by a combination of strong demand, an increase in the cost of raw materials and supply chain challenges. ASP increased 20% globally in the TCG market between April 2020 and April 2021 (see Chart 2).

Chart 2: Price development for TCG market

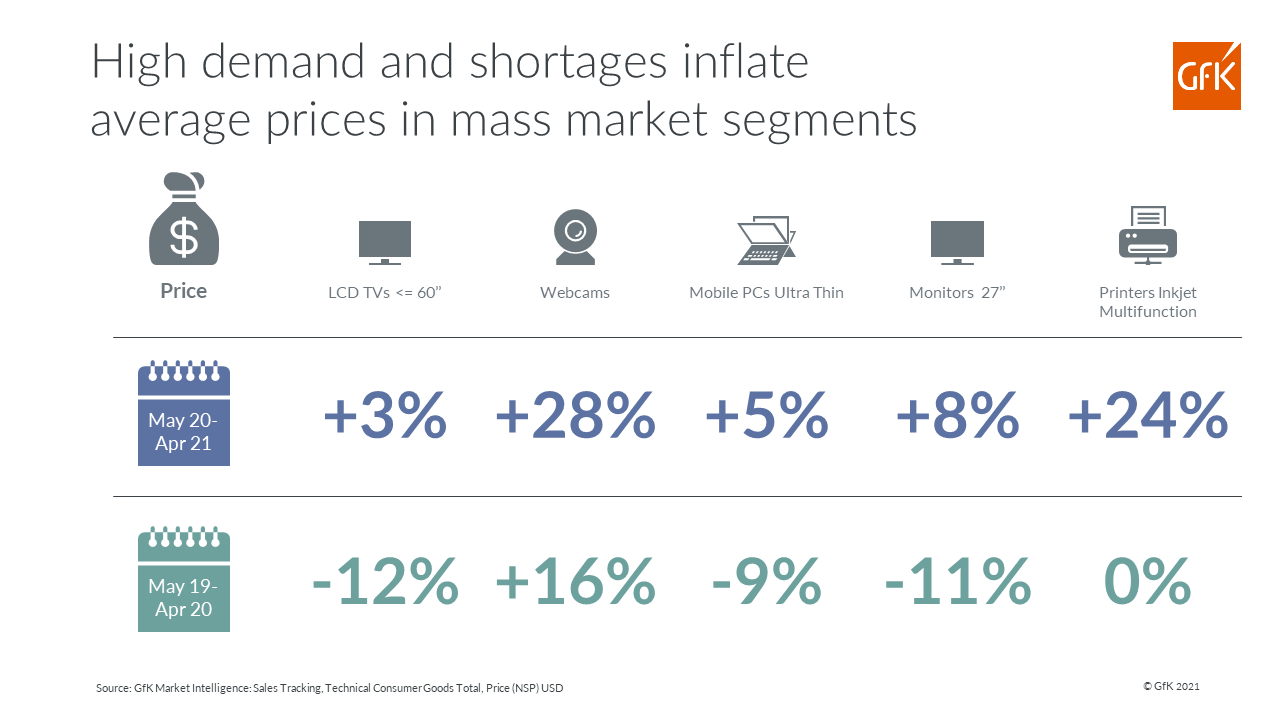

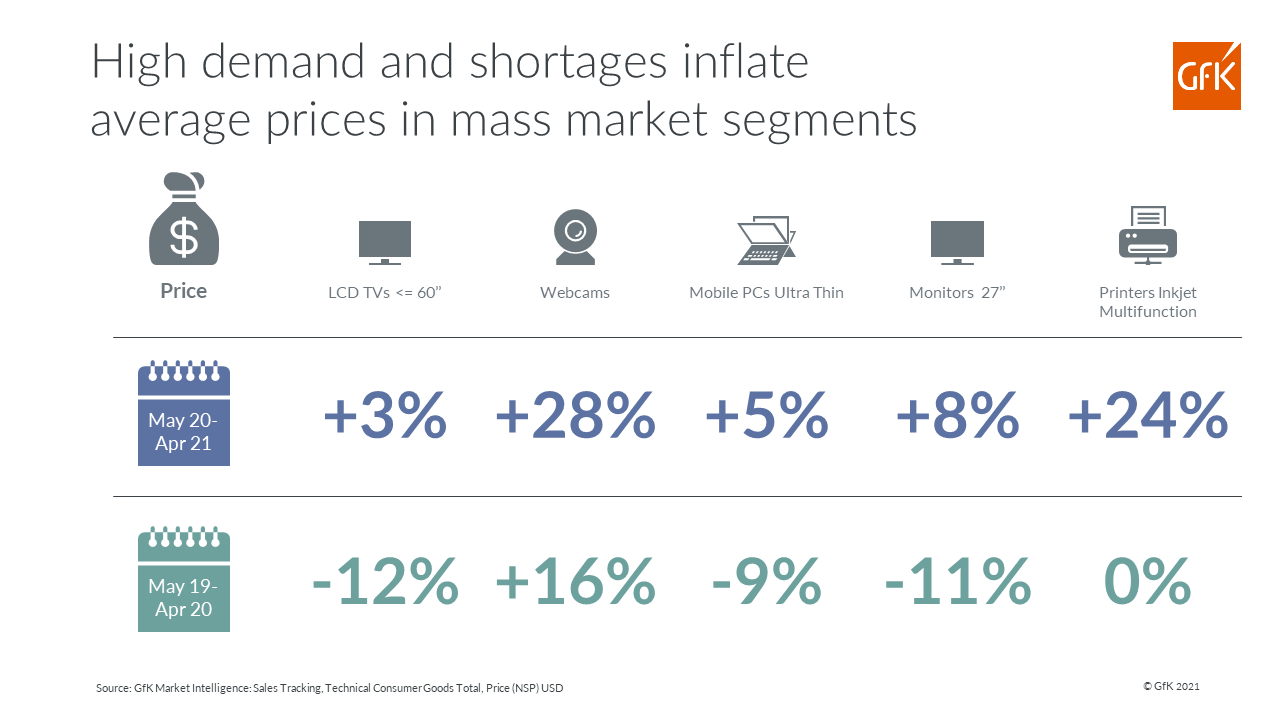

One of the main reasons for the rising price is the very high demand in the mass market segment. Usually, we observe falling prices in mass markets but during the last few months this trend has changed dramatically. For instance, looking at 60” LCD TVs, April 2021 prices are up 3% compared to May 2020, whereas in a ‘normal’ year we would expect them to fall, as they did between May 2019 and April 2020 where they dropped 12%. This trend is not unique to TVs, we have observed the same phenomenon in webcam prices, which are up 28%, printers (inkjet, multifunction) which have risen 24%, and 27’’ monitors, which are up 8%.

In addition to high demand, the exploding costs of commodities (for example of crude oil, steel and lithium), major increases in shipping costs and rises in LCD panel charges have impacted prices in every sector. Chip shortages have a particular impact on IT categories. The effects are even felt in the lesser technology-driven sectors like major domestic appliances which are impacted as chip manufacturers choose to prioritize the production of high-end chips rather than less complex ones (e.g., the microcontrollers used in washing machines or fridges).

Supply chain challenges: The pressure is on

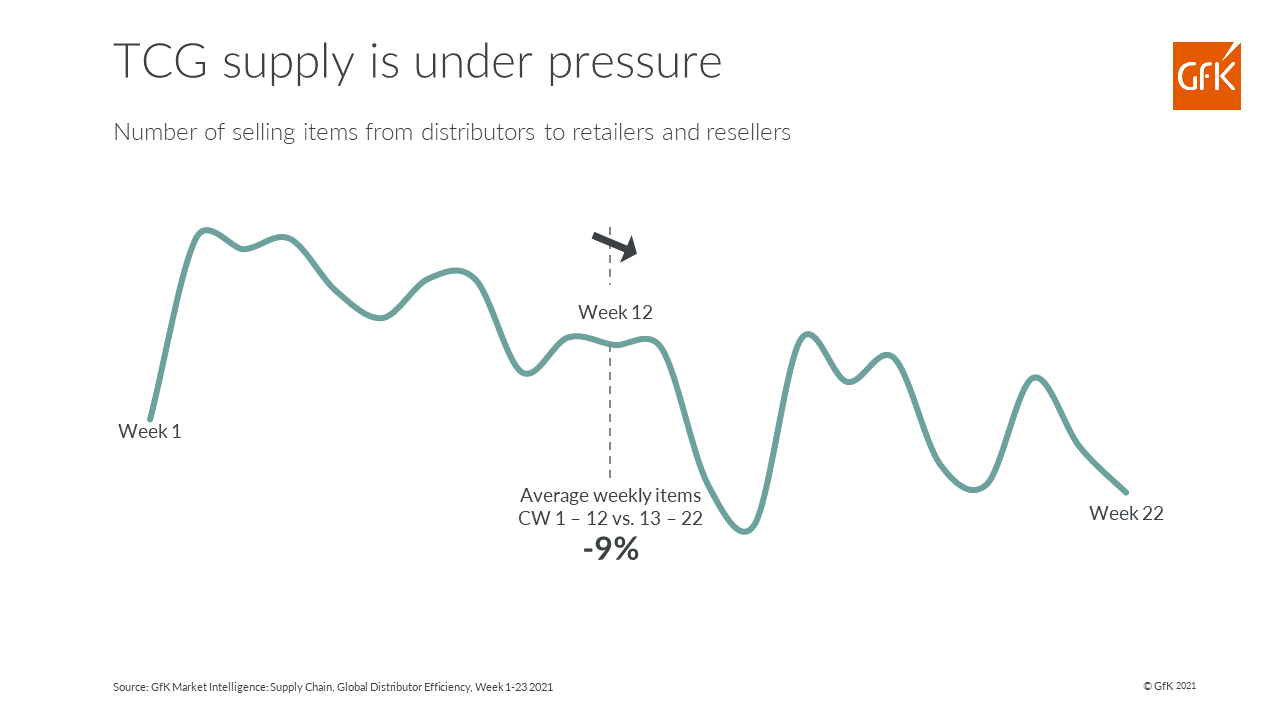

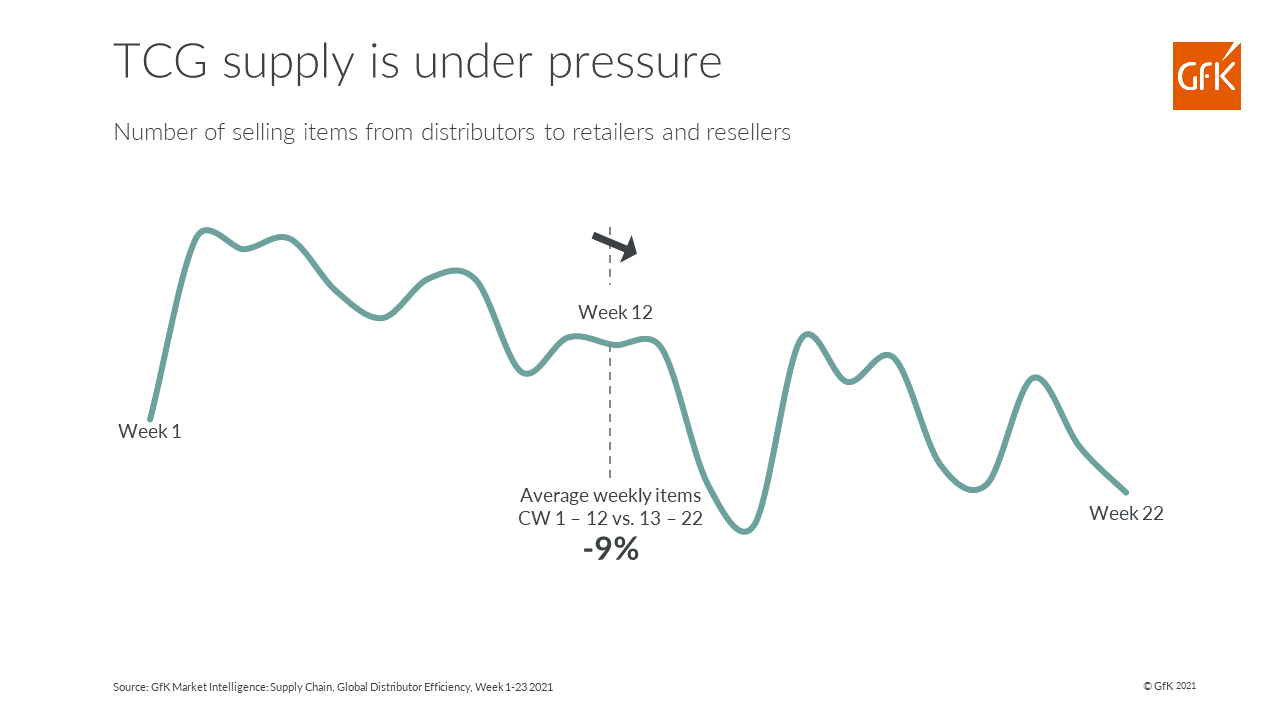

Distribution has been severely impacted by the pandemic, and the regular patterns of supply we were familiar with have changed drastically. In Q1 2021, Distributors exceeded sales expectations, but by Q2 2021 that resilience was starting to show signs of slowing down. Between weeks 13 and 22, there was a gradual decline in product availability which pushed average selling prices to retailers and resellers up 32% globally.

Our analysis of inventory trends shows a gradual drop in the number and choice of models available at distributors. From week one to 22, the downward trend in supply indicates just how much chip shortages and other pandemic-related disruptions are causing issues in supply chain management (Chart 3). The average number of selling items at distributors dropped 9% from week 13 to week 22 – pushing prices up.

Chart 3: Model/item availability at distributors

By comparing our two Market Intelligence datasets of Sales Tracking and Supply Chain, we can confirm that retailers and resellers are stocking up on TCG items. The share of goods being supplied by distributors has intensified, as retailers increased their sources to ensure full shelves. This activity of stocking up ensures consumers have the choice they want at retail. Where the right products or brands are not available at their preferred stores, consumers tend to shop around which inevitably has a negative impact on customer loyalty.

Looking ahead

Whatever the cause, the global sourcing problems impacting TCG are putting pressure on prices, and we expect supply chain challenges to remain a key feature of 2021. Product availability is going to be vital for success in 2021 with ongoing demand coming from consumers partially working at home. In addition, the B2B market presents a new opportunity, as governments and private companies invest in a new digital transformation and green IT infrastructure

As resellers and retailers try hard to keep their customers supplied with the items they want to buy, managing logistics and ensuring product availability is going to be essential in 2021. The relationship with distributors will be crucial as they partner with manufacturers to tackle limited model availability and supply issues. Whichever way the market unfolds, having access to the latest data from both the distributors and retailers is going to be an important element in securing those market wins.

This blog piece was developed in collaboration with Ercin Coskun, Product Manager of GfK Market Intelligence: Supply Chain.

Want to learn more about this topic?

Get the detailed presentation below.