02.05.2022

Keeping Watch on a Market in Motion

The more we understand about the US tire marketplace, the more we see that variation and inconsistency are everywhere. From 30,000 feet, it may seem that things are mostly stable and predictable; but a closer look reveals significant – sometimes dramatic – differences from month to month, category to category, and SKU to SKU.

COVID was the biggest lesson in market volatility that many of us have seen; in a matter of a few weeks, tire sales dropped 40% -- and no one knew where the bottom might be. How, in the midst of this completely unfamiliar scenario, could tire manufacturers and sellers make plans? How would they adapt to whatever might come next?

For many, these questions naturally led to a hunger for facts and insights about the marketplace – not opinion, but reliable information. Whatever we could know about the future would rely upon the past, both immediate and longterm. And, having found new resources, those who run large companies and small shops alike have recognized the ongoing value of trusted information – not just for crises, but for simple, everyday navigation.

The value of weekly and regional tires sell-out data

The latest example of this unpredictability and surprising variation in the tires market was revealed when GfK released the first weekly regional sell-out data from is nationwide POS panel of independent retailers. We found extraordinary disparities between the regions, with different levels of growth and sales.

During 2021, the Middle Atlantic states posted a remarkable 19% rise in revenue, with $2 billion in sales. While New England placed second in growth, it produced just $500 million in sales. Middle Atlantic also led in unit growth, at 12%, with roughly 12 million tires sold. New England came in third in terms of increase, at 7%, but it recorded just 4 million units.

Nationally, average tire prices grew 6% – but regional price increases ranged from 10% in West North Central to just 3% in Pacific. Comparing 2021 to 2019 – a two-year period – we found that prices have risen 7% overall, with regions varying from 5% to 11%.

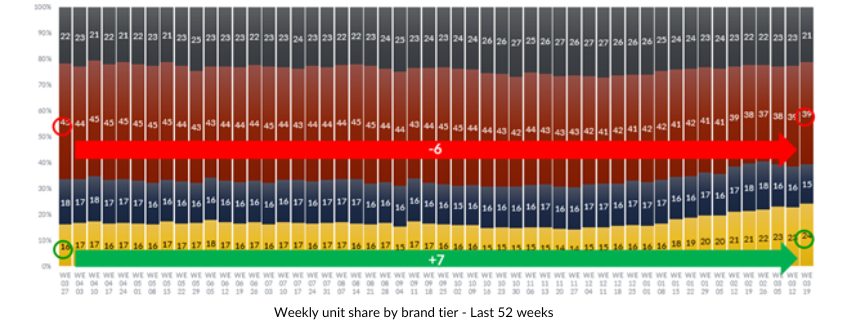

The availability of weekly data also surfaces emerging patterns more quickly; rather than waiting for the monthly report to come in – and wondering if it might be an anomaly or something more – we can see changes in action. Sales distribution by tier, for example, began a significant shift in January of this year, with Tier 2 losing ground while Tier 4 grew. Overall, this had the effect of lowering the channel price, a phenomenon we would not have understood with less granular reporting.

Weekly unit share by brand tier

Smaller retailers vs. Big-box stores

Smaller retailers today are under extraordinary decision-making pressure. They need to absorb insights on the fly and act quickly – and correctly. Big-box stores are reassessing their games all the time, and online shopping has made consumers more savvy and less predictable. Where will they buy, and at what price? Will brand loyalty trump price, or the other way around?

At the same time, manufacturers face their own challenges. Supply-chain interruptions have made stocking efficiency nearly impossible, and pricing at a time of massive inflation is a continual challenge. With all the curve balls in the air, we need to see the market clearly. COVID-9 showed the industry how lost decision makers can feel without the right data markers – but the truth is that this need exists all the time, at every level of business.

As data granularity and frequency ramp up, decisions making can only improve. Sometimes, gut will triumph – and sometimes it should. But we should decide from the gut while knowing all the facts, and not because the facts are nowhere to be found.

Neil Portnoy is managing director of GfK's POS Tracking team focusing on the U.S. tire industry. GfK maintains the only nationwide panel tracking sell-out data in the independent tire channel. Contact Neil at Neil.Portnoy@gfk.com.

This article originally appeared in Today's Tire Industry, published by the Tire Industry Association.

Watch our new On Demand webinar, Attracting High-Value Tire Service Customers, for deeper insight into the strategies on customer value.