The 2023 picture

2023 has seen consumers continuing at a muted level of spending. This is driven by ongoing uncertainty over their personal finances due to the global and regional impacts of high inflation and the increased price of food, energy and goods.

<div class="infogram-embed" data-id="_/jLy6CeXZZkqzu1CvUG9k" data-type="interactive" data-title="Copy: Retailers_01"></div>

Economic worries are top of mind everywhere. This continues to impact spend across almost all parts of life: 43% say that cost is a factor keeping them from buying smart home devices this year, while, last year, around a half agreed low running costs (e.g., fuel, repairs, insurance) are very important in a vehicle, or that environmentally friendly alternatives for many products they use are too expensive. This mindset is also evident in depressed sales across nearly all Consumer Tech & Durables (T&D) sectors in the first half of this year:

Our full year forecast for total T&D sales in 2023 is for a slight decline in sales revenue (US dollars) compared to 2022. But pause for a second and let us put this into perspective. While we expect all T&D sectors globally to remain in a degree of decline or only return low positive growth across the full year, the rate of that decline is slowing compared to last year.

The indications are that demand is starting to recover and that 2024, played wisely, presents opportunity for a much wider-spread return to positive growth across the majority of T&D sectors.

Consumer confidence has also turned a corner, climbing cautiously from the rock-bottom levels we saw in 2022. Europe, for example, has shown steady improvement since the end of 2022, although it remains at a very low level compared to pre-pandemic days.

Stabilization, not normalization

What we are seeing is a degree of stabilization – but certainly not a return to what we knew as “normal”. We are in a very different place to 2019.

T&D markets are facing what could be termed a perfect storm. The peak sales of 2020 and 2021 — caused by consumers moving their purchases forward during lockdowns – has left high levels of saturation in key categories, such as TVs, food preparation appliances, coffee machines, and entry-to-mid level mobile PCs. Supply chain issues also started during the pandemic and were exacerbated in many world regions by the Russian attack on Ukraine in February 2022.

On the heels of that came soaring inflation and cost of living, which depressed consumers’ urge to replace or upgrade products early — along with their rising focus on out-of-home activities pulling them multiple ways in where to spend their reduced levels of disposable income.

On top of all this, manufacturers and retailers have the challenge of high levels of inventory left from 2022 as consumers reined in their spending, and demand faded, especially for high-energy-use items such as tumble dryers and washer-dryers. If 2022 was characterized by a volatility of supply, the first six months of 2023 were characterized by volatility of demand.

<div class="infogram-embed" data-id="_/kHesxoBDW42hxLo0MNwO" data-type="interactive" data-title="Manufacturers_8"></div>

With people very much focused on saving money, many are waiting for either a very attractive price deal or an inspirational product innovation before buying a new main device. Until then, they are taking the lower-cost option of enhancing their existing set-up with higher-performance or clutter-free accessories.

- Gaming keyboards (corded) -17% vs. Gaming keyboards (cordless) +37% YTD

- Solid-state drives (SSDs) +3%s vs. latest NVMe SSD's +30% YTD

- True Wireless Headphone +1% vs. Bluetooth headband earphones +31% value YTD

Source: GfK Market Intelligence, Sales tracking – global (excl N. America), Jan-Jun 2023

For retailers and manufacturers, this current consumer mindset presents a challenge. Although the share of newly launched products in categories such as TVs, smart-mobilephones, laptops, etc is similar to pre-covid levels, there has been a lack of ‘the next big thing’ in most sectors. Disruption driven by launches of dramatic product innovation has been low this year – with the result that TVs, for example, saw 41% of sales in H1 being for models launched two or more years ago, compared with 29% in H1 2019. Consumers are often not seeing a persuasive reason to buy the latest and newly launched products, which also points towards elevated inventories at retail stores.

While significant discounts obviously impact retailers’ margins, the results of summer promotions this year show that these events are motivating consumers to open their wallets. We therefore expect similar promotions will be crucial to trigger volume demand in the remainder of 2023.

There are always exceptions to the rule; In certain regions, certain brands have declared they will not be doing aggressive promotions this year. Overall, however, our expectation is that Black Friday 2023 will see discounts at levels beyond prior years, owing to consumers deliberately timing their purchases for these events, and retailers wanting to clear old stock more than in the past year

What will drive consumer spend in 2024?

1. Product lifetime costs

This trend is an extension of the sustainability mindset but also embodies people’s multi-layered and sometimes contradictory requirements. It combines their need to save money, while also wanting to enjoy high-performing products that make their lives more convenient, and to reduce the impact they have on the environment.

As well as looking at the initial purchase cost of an item, shoppers are also considering its operational cost across its full lifetime – its durability, repairability, upgradability, how much energy or water it uses. For consumers weighing up the overall value of a purchase, these products are also more environmentally-friendly in the long-term – a factor that continues to be important to shoppers, despite their competing need to save money.

<div class="infogram-embed" data-id="_/ERtfE1QuptJGB6wTvidE" data-type="interactive" data-title="Manufacturers_9"></div>

The crucial question for manufacturers and retailers is: which of these factors rise above the others for different consumers when buying specific types of products. For example — when choosing home appliances, the energy consumption factor takes greater prominence in people’s purchase decision, compared to when they are choosing a digital device, which uses comparatively little energy.

Brands that get their positioning exactly right can win on two levels:

- Consumers are willing to invest in higher-priced models, in order to get a product that will cost them less to run in the long-term.

This is most evident in MDA, where consumers run products several times a week, if not daily, and products are comparatively energy-hungry. Here, the products with the highest ratings for energy efficiency command a significant price premium. This has not dampened consumer take-up of these products, as they expect to recoup that investment in energy savings over the years, as well as enjoying the warm feeling of making a more environmentally friendly purchase. In some regions and categories, energy-efficiency labelling and even repairability labelling (for vacuum cleaners in France) is already mandated by legislation – ensuring that consumers have a yardstick by which to measure the sustainability of their intended purchase. - Being perceived as a brand that puts the consumer ahead of pure profits.

By presenting consumers with products that last longer before needing to be replaced, manufacturers and retailers take a revenue hit on the reduced frequency of purchase. This is only partially made up for by the higher average selling price. However, there are significant gains to be made in the form of brand loyalty and word-of-mouth around being a brand that delivers on multiple levels: helping people save money in the long-term, while delivering products that genuinely make their lives easier or more enjoyable, and, at the same time, reducing the environmental impact.

This positioning is particularly suited to major and small domestic appliances, as well as inkjet printing devices and consumables, but requires extra thinking for tech and IT products. Here, the pace of improvement in technical specifications (memory, display quality, graphics, etc.) means that consumers who value getting the highest performance levels will still wish to upgrade their devices more frequently. The messaging and targeting therefore needs to be different for digital products.

Adapting to a reduction in our throw-away culture

In order to keep revenue flowing in a world of lengthening replacement cycles, manufacturers and retailers will need to get creative with their business models. Concepts could include subscription-service-plus-hardware models (such as Streaming Provider offerings) or MDA subscription models where old appliances are taken back at the end of the original consumer’s subscription to be refurbished and offered for subscription again. The benefit for the manufacturer is that the value they receive from the appliance increases the longer it lasts, while also benefiting the sustainable and durable product mindset.

These concepts already present strong opportunity across T&D, with growing consumer interest in circular economy or refurbished products. 27% of global consumers today have purchased some type of item second hand instead of new – up from 21% ten years ago. Given the two core drivers of wanting to save money and also be more sustainable, demand for both circular economy and refurbished items is expected to increase.

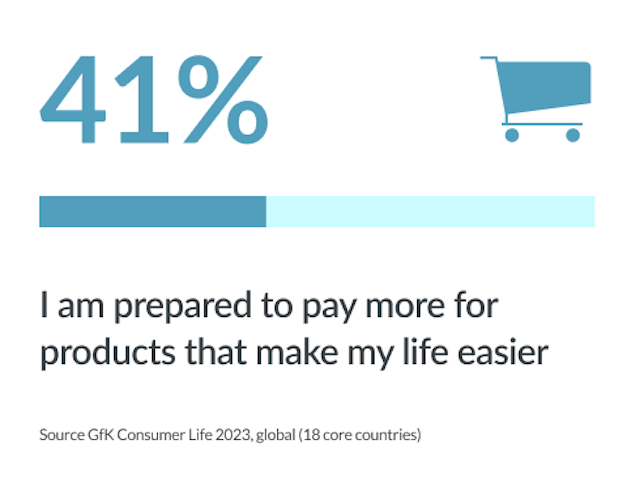

2. Making life easier

Another enduring consumer trend is the pressure to fit more into each 24 hours: work, domestic tasks, family, friends, hobbies, healthy living, wellness.

Product or service innovation in these areas does not need to be revolutionary; in most cases it's evolutionary - simplifying daily chores, allowing greater control remotely, enabling reduction of energy use, facilitating being mobile. Here, robotic, multifunctional, smart and cordless products that are easy to use and make people’s lives more convenienthave witnessed an ongoing appeal among consumers in the T&D market.

-

“Cost-conscious consumers are looking for innovation that enables their flexible living, long-term money saving, or is designed specifically for their niche user group. Solutions that are in search of a problem are not cutting through.”Warren SaundersGlobal President, Tech and Durables

Robotics

Robotics is transforming the way we manage our domestic environment. From automated cleaning and maintenance to personalized assistance and enhanced security, robotics delivers huge value in time-saving and releasing people from routine chores. The popularity of this area is seen in robot vacuum cleaners and robot lawnmowers. Despite a recent slowdown (in line with overall T&D market deceleration), 24% of total vacuum cleaners sold today are robot vacuum cleaners (and 94% of these robots are smart). Similarly, 21% of total lawn mowers are robot lawn mowers.

Multifunctional

Continuing with the example of robot vacuum cleaners, these also show the strong consumer attraction towards multifunctional devices that specifically match their living needs. After peak sales in 2020 and 2021, overall sales of robot vacuum cleaners declined -8% in Jan-Jun 2023. In contrast, the new generation of multifunctional robot models, which have docking stations and can vacuum and mop, grew -2% in the same period. It is the same for their docking stations. The 1st generation of docking stations only provided charging – and this segment is already in decline. Models which allow charging and dry extraction grew by 1% Jan-June 2023, while the latest docking stations, which allow for dry and wet extraction, saw strong growth of 157% in the same period.

Flexibility & mobility

Smart functionality

is a key lever of premiumization. A top example is (again!) smart robot vacuum cleaners. These have cracked the mass market even though they cost close to four times the price of non-smart versions (an average of $423 compared to $116). Their use case is so strong that 94% of the global volume assortment of robot vacuum cleaners are now smart. Other examples are smart panel TVs, thermostat controls, intruder security and visual cams, which are all now mass-market items, plus consumers are increasingly seeing the benefits of smart door communications, movement detectors and dishwashers.

Domestic appliances already offer an impressive assortment of smart products in both MDA and SDA, but to earn mass-market adoption, the smart function must deliver a highly practical use case.

Opportunities for MDA and SDA lie in the evolution of smart functionality that includes AI that automatically personalizes appliance settings to save energy, based on the individual user’s lifestyle. This would mean, for example, refrigerators that recognize when you are out of the house and automatically reduce the compressor activity since the appliance door will not be in use to let out the cold air. Similarly, washing machines and dishwashers that use multiple sensors to identify the most energy-efficient program, as well as analyzing their regular usage to propose settings to save energy and water, and therefore money. Or major appliances that allow maintenance analytics to be run remotely, reducing the need for expensive in-person home visits by repair staff.

52%

Source: GfK Consumer Life 2023, global

Cordless products

that enable consumers to break free from the clutter and inconvenience of cables continue to outperform their category average. This is seen across the product groups, from cordless vacuum cleaners, power tools and lawn mowers to wireless keyboards, mice, headphones and hair stylers.

In the IT sector, bluetooth keyboards and mice have grown +15 percent and +10 percent in the first half of 2023, respectively – and the continued popularity of hybrid working is likely to offer additional growth opportunities from 2024. People will then be ready to upgrade their home offices (set up during lockdowns) with wireless accessories that deliver a clutter-free, and therefore more enjoyable, working environment – as well as devices suited to smaller workstations or "workation". Purchases of compact keyboards are already rising, with ten-keyless devices growing by +11 percent in the first half of the year compared to 2022, while standard formats declined by -10 percent.

<div class="infogram-embed" data-id="_/IXbbTZW9pdEJLYKk6oJZ" data-type="interactive" data-title="Manufacturers_10"></div>

3. Individualism and the tailored experience

<div class="infogram-embed" data-id="_/awB4qP9dbdN3Aqlo4Dzl" data-type="interactive" data-title="Manufacturers_11"></div>

Current shopper mindset is more focused. People are keeping their ‘treat myself’ spend for products designed specifically for an area of life or activity that matters to them as an individual or niche group. Examples include digital content creation, gaming, fitness, cooking, photography, and more.

They see value in investing in higher-performance, quality products – even though these come with a higher purchase price – when these directly enhance their experience of an activity that matters to them.

<div class="infogram-embed" data-id="_/6osa8YHFreeymXkXqEcH" data-type="interactive" data-title="Manufacturers_12"></div>

Current shopper mindset is more focused. People are keeping their ‘treat myself’ spend for products designed specifically for an area of life or activity that matters to them as an individual or niche group. Examples include digital content creation, gaming, fitness, cooking, photography, and more.

They see value in investing in higher-performance, quality products – even though these come with a higher purchase price – when these directly enhance their experience of an activity that matters to them.

Digital content creation

Every minute last year, an average of 167 million TikTok videos were watched, 500 hours of video content were uploaded to YouTube, and 70,200 photos were uploaded to Instagram. The result is that the digital content creation market – covering everything from editing PCs and software to cameras, tripods, lighting, and storage - is forecast to reach around USD 24.73 billion globally by 2027.

People are willing to pay higher prices for devices that specifically enable content creation. For mobile PCs, the average selling price in Q1 2023 was $695 USD for the category average, but $980 USD for models designed for content creation. Similarly for digital cameras: the category average selling price was $935 USD, but $3,361 for models with >=4K video resolution that enable enhanced content creation.

Gaming

Monitors and mobile PCs specifically designed for gaming continue to outperform in sales value growth, even with the respective categories being in overall decline due to a saturated base. Consoles are also expected to grow now that delivery disruptions for Playstation are resolved, new models are expected in the market, and new games have been announced which may drive consumers to get new hardware.

Smartphones

Our tracking of smartphone sales shows consumers prolonging their replacement cycle, with almost 60% now not renewing for three years or more. People see no reason to upgrade, since there has been little innovation pull in recent years. The one exception is in hardware, with the launch of foldable screens. This segment is still highly niche, but it is growing, driven by the aspirational design as well as the convenience of pocket-size carrying but full-size use.

The MDA market

is still seeing models with aspirational features outperforming the group average, but this demand for premium features is slowing. Consumers are looking for the best value and trade-off to meet their price expectation, and so are leaning more to the ‘affordable premium’, i.e. lower-price models within the premium segments. However, this trend varies considerably by region and even country, based on local inflation, currency rates and economic developments.

For example, in Western Europe, high-capacity washing machines and extra high refrigerators still saw double-digit value growth in Q1 2023, but ovens with steam injection dropped –11%, while hobs with integrated hoods dropped –4%. In Southeast Asia, aspirational segments like side-by-side and multi-door refrigeration stopped growing their revenue shares, driven by price declines.

What we’re seeing in MDA is the long-term growth drivers of capacity and function slowing down, if not coming to an end. Consumers are switching their demand to energy efficient and smart models, with their aspirations in this sector becoming far more about making life easier and saving money.

4. Environment and sustainability

<div class="infogram-embed" data-id="_/ZilmGZrnsdHa8Pe0WHqf" data-type="interactive" data-title="Manufacturers_13"></div>

Nearly three-quarters of people around the world see “Global climate change / global warming” as a very or extremely serious issue. It has risen to be the #5 top consumer concern today, up from #6 last year and #7 in 2021. To put that into perspective, this places it not far behind the issues of “inflation & high prices”, “having enough money to pay the bills”, and “recession and unemployment” that all have a very direct impact on people’s personal living.

This fact is affecting consumer spending in two ways:

- Needs-based purchases to combat the effect of climate on daily lives – such as electric fans, air purifiers and air conditioners

- Values-based purchases, driven by people’s desire to place their spend with brands and products that are eco-friendly. Especially in the Developed World (US, Europe and Developed Asia), there is a growing awareness of the pollution problem and the regions’ high carbon footprint. This awareness is helping to fuel sustainability as a personal value in these regions, and their higher affordability makes taking action easier.

<div class="infogram-embed" data-id="_/zMrJ0MM0659HI6HrVTXz" data-type="interactive" data-title="Manufacturers_14"></div>

Currently, 46% of shoppers around the world say they take environmental protection factors into account when deciding which item to buy (up +1 percentage point since 2022). By 2030, we estimate that 50% of consumers globally will be “eco-active shoppers” who will wield a potential spend of >$1,000 billion on FMCG and >$700 billion on consumer tech & durables.

Importantly, people’s need to reduce their energy consumption in order to save money dovetails with their wish to be greener in what they buy and the impact they have. By buying products that use less energy or water, these consumers feel they are scoring on two levels. They are saving themselves money in the long term, as well as being green in the slipstream. Already, 73% of people around the world are conserving energy at home by using energy efficient products (up +3 pp since last year).

The revenue opportunity available from this segment of consumers is especially seen in kitchen appliances. In Europe, where energy prices rose sharply, combi fridges with energy efficiency ratings of A, B or C grew +75% in value in Q1 this year compared to 2022, while freestanding dishwashers with the same labels grew +40%.

Critically too, eco-concerns are no longer the focus of mainly younger generations. Global consumers aged 60+ have surged in the number that see climate change as a serious issue, to hit 70%. They now run level with teenagers on this - but with far more income at their disposal to take action on their concerns by influencing what they buy.

Only 57% of T&D shoppers say that they perceive at least one of the top 10 brands as being environmentally friendly (gfknewron Consumer Q4 2022). To compare that against a relevant benchmark, 95% of T&D consumers perceive one of the top 10 brands as being a high-quality brand. This clearly points at the existing gap as consumers lack a clear image of eco-friendly brands – and hence there remains huge opportunity for brands that are able to position themselves convincingly in this area.

However, consumers’ expectations here are expanding. In order to be perceived as genuinely eco-friendly, manufacturers and retailers need to be able to point to everything from the suppliers they work with...to their products’ material, packaging, transportation, durability, recyclability...to their support of environmental or humanitarian causes.

This is a natural expansion of what we are already seeing at product level. In the EU5’s highly competitive smart-mobilephone market, two-thirds of sales revenue in January to June this year came from products that are promoted with 3 or more eco-claims. With a growth rate of +22%, these items are substantially out-performing the rest.

Planning for 2024

How do manufacturers and retailers capitalize on the consumer trends above to shape an ambitious but sustainable strategic plan and budget allocation for 2024+?

With brands right in the middle of budget planning for 2024, these are our global recommendations on how to drive growth over the next few years.

-

Invest in targeted innovation (product & service)

As shown above, consumers are no longer in the mindset of novelty for the sake of novelty – so successful innovation will not be simply about adding in the latest tech features to products. To tempt consumers into replacing their existing items, or upgrading to ‘affordable premium’ models, they need to see a use case showing the value that the extra spend will bring, relevant to their needs. The means use cases crafted around the trends given in this report, and adapted to the specific nuances of each region and consumer segmentation.

For T&D, innovation and positioning for 2024 should also focus around building modularity into products and services, as well as “bundling” and producing high-performance accessories to main products. This is about enabling consumers who are not able to justify buying a new core device to either buy-in at a lower level with a view to upscaling later, or to upgrade their existing device with add-ons that enhance the user experience.

These approaches can target and draw out spend even in saturated markets and with consumers being cautious with their spend. -

Build your brand as a differentiator

With the budget planning already well underway, it is vital to balance both short term point-of-purchase activity and long-term, top of funnel brand building activity.

Markets around the world are showing signs of stabilizing, but the path ahead is not without obstacles. Inflation is still chipping away at disposable incomes and the risk of recession remains a concern for many countries and regions.In this environment, your brand’s emotional connection with consumers plays a crucial role. It enables a strategy of differentiating on brand to win over consumers hesitating about which product to choose, rather than relying purely on product differentiation or pricing.

This is an area where T&D can absorb lessons from successful strategies seen in FMCG. There, savvy brands have invested in their upper-funnel brand marketing to build an emotional connection between consumers and their brand. When the cost-of-living crisis hit, this has helped those brands stay relevant and differentiated, and maintain their place in shoppers’ trolleys. -

Intensify manufacturer-retailer collaboration to optimize omnichannel category management

Everyone has seen their shoppers undertaking ever more complex journeys that combine multiple channels when buying T&D goods. The benefit of delivering a consistent messaging and experience, whatever the channel or touchpoint, is therefore more crucial than ever. Added to this, consumers are increasing their expectations around how they are served by retailers – from the ability to choose from multiple delivery and payment options, to receiving tailored offers matched to their preferences.

To really stand out across the entire shopper journey requires manufacturers and their retailers to work even more collaboratively. Rather than each competing to gain extra profit from the other, those manufacturers and retailers who are able to form a long-term and mutually beneficial relationship will gain a combined competitive edge. By teaming up to produce consumer-centric plans that are unified across their respective merchandising, marketing and supply chains, these teams can better deliver their mutual goal of creating a consistently enjoyable and personalised overall experience for consumers. -

Planning for the upcoming shopper generation:

Gen Z will soon surpass millennials as the biggest generation in terms of numbers. According to INTO Global (leaders in international recruitment and education): of the 1.8+ billion Gen Z individuals worldwide, over 515 million reside in South Asia, followed by Africa, Central Asia and South America. India alone has a Gen Z population exceeding 374 million - nearly three times the number in the whole of Europe. Or, to put it another way, there are more Gen Zers in India than there are people in the United States.

The full generation is currently aged 10-24, but two-thirds are aged 15-24 and starting to frame their opinions about brands. They are a digitally native age group, many of whom won’t remember time before smartphones. They have the benefit of democratized information – but also an overload of information. They consume about 53% more content than the average person, but spend 50% less time on content than millennials do. They are also – like any generation – a highly mixed ‘group’, with many segmentations and differing demands.

-

Review regional and category footprint, and consider expansion, to capitalize regional growth opportunities and mitigate individual category risks

Each geographical region has unique market, category, and consumer dynamics. There are significant differences in the levels of market saturation and product demand across categories, the impact of inflation and price rises, and in people’s level of confidence and disposable income. To identify the pockets of opportunity available to them, manufacturers and retailers need to have a full view of all regions and categories, and map this against their own portfolio to pinpoint where growth is most likely – thereby minimizing the level of risk in their planning for 2024 and beyond.

Authors

Endorsed by