London,

21.04.2023

Consumer confidence up six points in April to -30

As all measures jump, are we seeing early signs of recovery?

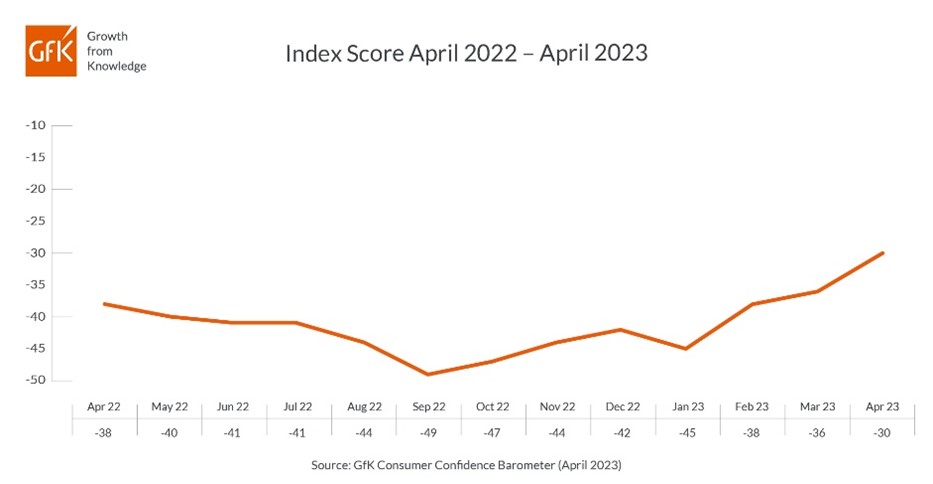

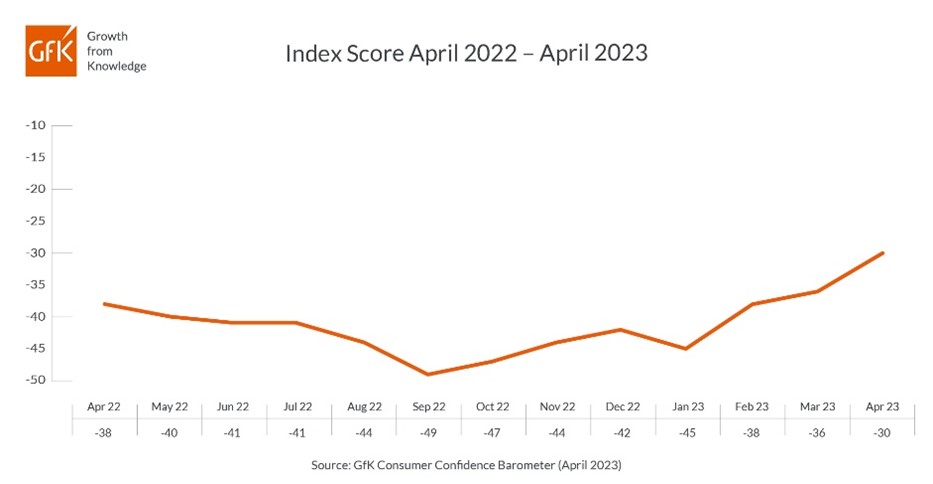

GfK’s long-running Consumer Confidence Index increased six points to -30 in April. All measures were up in comparison to last month’s announcement.

Joe Staton, Client Strategy Director GfK, says: “As food and energy prices continue to rise, and inflation eats into wages, the cost-of-living crisis is a painful day-to-day reality for many. But are all consumers buckling under the pressure? On the evidence of April’s confidence figures, the answer is no. Instead, there’s a sudden flowering of optimism with big improvements across the board. The eight-point jump in how we see prospects for our personal financial situation is a dramatic change that might suggest household finances are stronger than we thought. The brighter views on what the general economy has in store for us, with April’s six-point rise cementing a 20-point improvement since January, could even be seen as the proverbial ‘green shoots of recovery’. Moreover, the Major Purchase Index at -28 is higher than it has been for a year and will bring much-needed cheer to retailers as we head into summer. This is the third month in a row that confidence overall has improved; can we look forward to this momentum building for the year ahead?”

UK Consumer Confidence Measures – April 2023

The Overall Index Score increased six points to -30 in April. All measures were up in comparison to last month’s announcement.

Personal Financial Situation

The index measuring changes in personal finances during the last 12 months is up five points at -21; this is two points worse than April 2022.

The forecast for personal finances over the next 12 months increased eight points to -13, which is 13 points higher than this time last year.

General Economic Situation

The measure for the general economic situation of the country during the last 12 months is up seven points at -55; this is five points higher than in April 2022.

Expectations for the general economic situation over the next 12 months have increased by six points to -34; this is 21 points better than April 2022.

Major Purchase Index

The Major Purchase Index is up five points to -28; this is four points higher than this month last year.

Savings Index

The Savings Index is down two points this month at +19; this is nine points higher than this time last year.

----

Notes to editor

Please source all information to GfK.

Press contact: for further details or to arrange an interview, please contact Greenfields Communications:

Stuart Ridsdale E: stuart@greenfieldscommunications.com T +44 (0) 7790 951229 OR

Lucy Green E:

lucy@greenfieldscommunications.com T +44 (0) 7817 698366

----

About the survey

- The UK Consumer Confidence Barometer is conducted by GfK.

- This month’s survey was conducted among a sample of 2,000 individuals aged 16+.

- Quotas are imposed on age, sex, region and social class to ensure the final sample is representative of the UK population.

- Interviewing was conducted between April 3rd and April 13th

- The figures contained within the Consumer Confidence Barometer have an estimated margin of error of +/-2%.

- The Overall Index Score is calculated using underlying data that runs to two decimal points.

- Press release dates for the remainder of 2023 are: May 19th; June 23rd; July 21st; Aug 25th; Sept 22nd; October 20th; November 24th; and December 15th.

- Any published material requires a reference to GfK e.g., ‘Research carried out by GfK.’

- This study has been running since 1974. Back data is available from 2006.

- The table below is an overview of the questions asked to obtain the individual index measures:

Personal Financial Situation

(Q1/Q2)

|

This index is based on the following questions to consumers: ‘How has the financial situation of your household changed over the last 12 months?’

‘How do you expect the financial position of your household to change over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse)

|

|

General Economic Situation

(Q3/Q4)

|

This index is based on the following questions to consumers: ‘How do you think the general economic situation in this country has changed over the last 12 months?’

‘How do you expect the general economic situation in this country to develop over the next 12 months?’

(a lot better – a little better – stay(ed) the same – a little worse - a lot worse)

|

|

Major Purchase Index

(Q8)

|

This index is based on the following question to consumers: ‘In view of the general economic situation, do you think now is the right time for people to make major purchases such as furniture or electrical goods?’

(right time – neither right nor wrong time – wrong time)

|

|

Savings

Index

(Q10)

|

This index is based on the following question to consumers: ‘In view of the general economic situation do you think now is?’ (a very good time to save – a fairly good time to save – not a good time to save – a very bad time to save)

(Commented on but not included in the Index Score)

|

GfK. Growth from Knowledge.

For over 85 years, we have earned the trust of our clients around the world by solving critical business questions in their decision-making process around consumers, markets, brands and media. Our reliable data and insights, together with advanced AI capabilities, have revolutionized access to real-time actionable recommendations that drive marketing, sales and organizational effectiveness of our clients and partners. That’s how we promise and deliver “Growth from Knowledge”.