New York, NY,

05.01.2023

Status, self-image top the list of reasons for intending to buy an all-electric vehicle – GfK report

While the carbon footprints of electric vehicles may be grabbing headlines, consumers planning to buy EVs often seem to care more about how the cars look in their social media feeds.

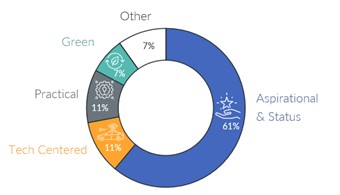

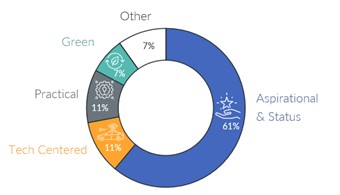

According to a new GfK AutoMobility® report, “The Future of Mobility,” aspirational and status-driven feelings exert the strongest influence on those intending to buy an EV, accounting for 61% of the total influence on intenders. (See Chart 1.) These attitudes include

- “Owning an electric vehicle projects who I want to be”

- “I am or want to be the first in my social circle to buy an electric vehicle”

- “I would feel great driving an electric vehicle”

Click here to download a sample of “The Future of Mobility”

Chart 1. Top attitudes driving interest in EVs

A love of technology and gadgets – wanting to own the latest technology and feeling that they “would love if vehicles could just drive themselves” – accounts for another 11% of the total influence driving EV intention.

By contrast, a commitment to the environment is a minor factor, exerting only 7% of the total influence. Another 11% is related to the practicality of electric vehicles (“would benefit my finances by not having to buy gas”).

But when asked how they would “justify” the decision to purchase an EV, if and when they actually do buy one, these intenders fell back on practical and environment-driven explanations – fuel economy gains, reducing emissions to fight climate change, and reducing reliance on oil.

Differences between Luxury and Non-Luxury intenders

People who are planning to buy a Luxury vehicle are more drawn to the status-related aspects of EVs. When asked what would make them more likely to consider an EV, Luxury intenders are more likely to cite “attractive styling” and “powerful acceleration,” while Non-Luxury intenders would be drawn to an EV that was similar in price to a gas-powered car.

Many intenders – especially those expecting to buy a Non-Luxury vehicle – also seem uncertain about whether EVs are really the best thing for the planet. When asked to cite the auto technology that they think is best for the environment, just 28% of overall intenders choose all-electric vehicles. Among Non-Luxury buyers, the proportion is 26%, versus 40% for Luxury.

“Sales trends only tell a fraction of the story in today’s auto marketplace,” said Tom Neri, Commercial Director at GfK North America. “Understanding why EV intenders are drawn to these vehicles, and what their areas of concern might be, is essential strategic information for OEMs, dealers, and other stakeholders. While buying an EV may indeed be a plus for the environment, the underlying reasons are complex and all-important.”

GfK AutoMobility® is the leading Auto Intenders Brand and Attitude Insights research in the US. Since 1982, GfK’s Automotive Purchase Funnel has been the bedrock for analysis and insights throughout the automotive industry. The funnel consistently tracks performance throughout each stage of the purchase process, determines competitive strengths and weaknesses, assesses consumer responses to marketing actions, and provides you with overall guidance and diagnostics for managing marketing actions.