London,

20.11.2020

UK Consumer Confidence down two points to -33 in November

GfK’s long-running Consumer Confidence Index decreased two points to -33 for November, with three of the five measures dropping compared to the October 23rd announcement. The other two were unchanged.

Joe Staton, Client Strategy Director GfK, says:

“In our post-lockdown, pre-vaccine Index this month, we report another deterioration in overall consumer confidence to minus -33, a drop of two points.

"Although there is no movement in our views on the economy, people are clearly losing their nerve regarding their personal finances with scores for the last 12 months and the year to come sharply down by seven points and five points respectively.

"This will deal a blow to any future rebound, because bullish consumer spending fuels the UK economy and low confidence is the enemy of recovery. The second lockdown couldn’t have come at a worse time for the UK’s high-street retailers and it’s no surprise that our major purchase sub-measure is once again mired deep in negative territory.

"On all fronts, economic headwinds still outnumber tailwinds and consumers can be excused for showing little in the way of Christmas cheer at present.”

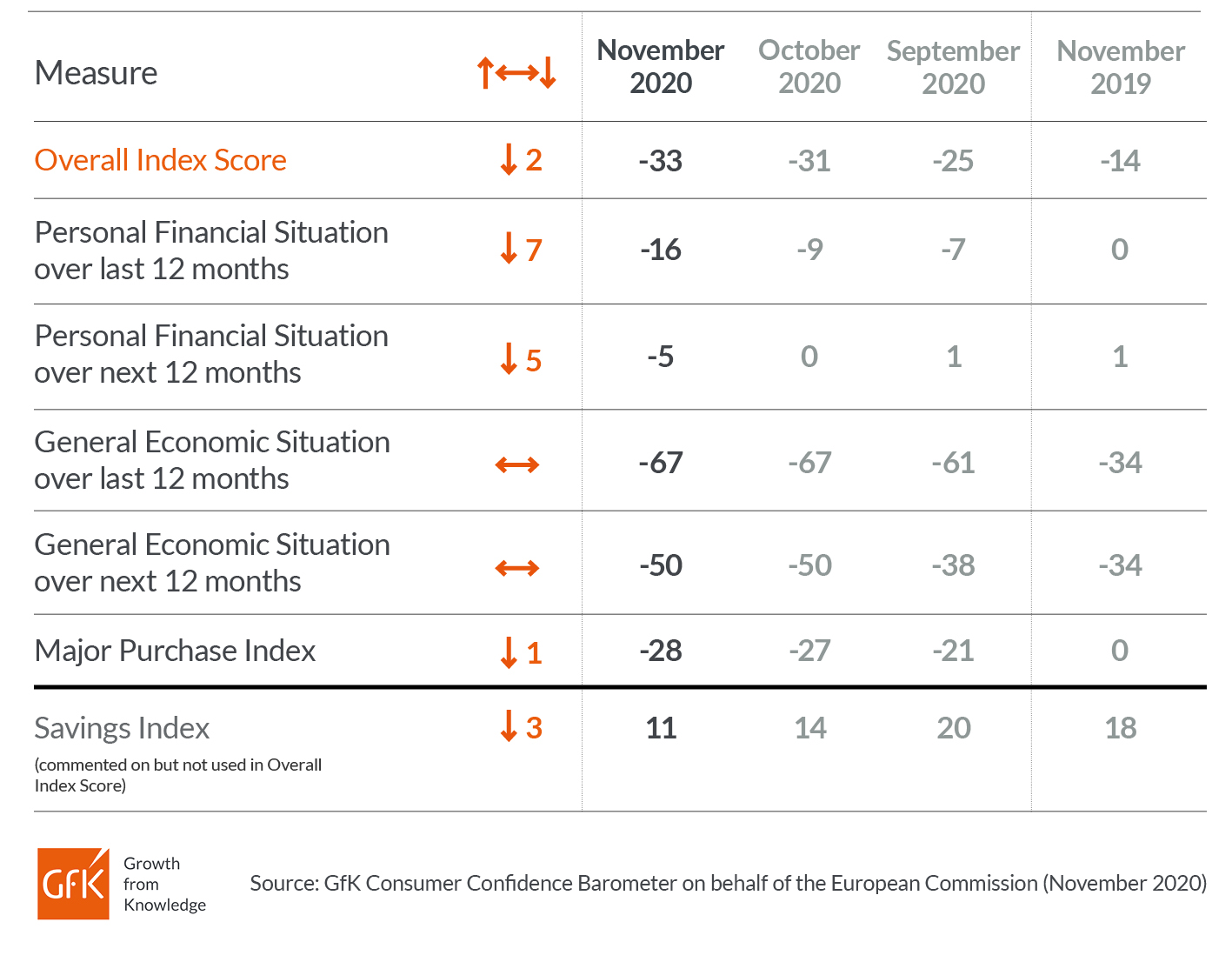

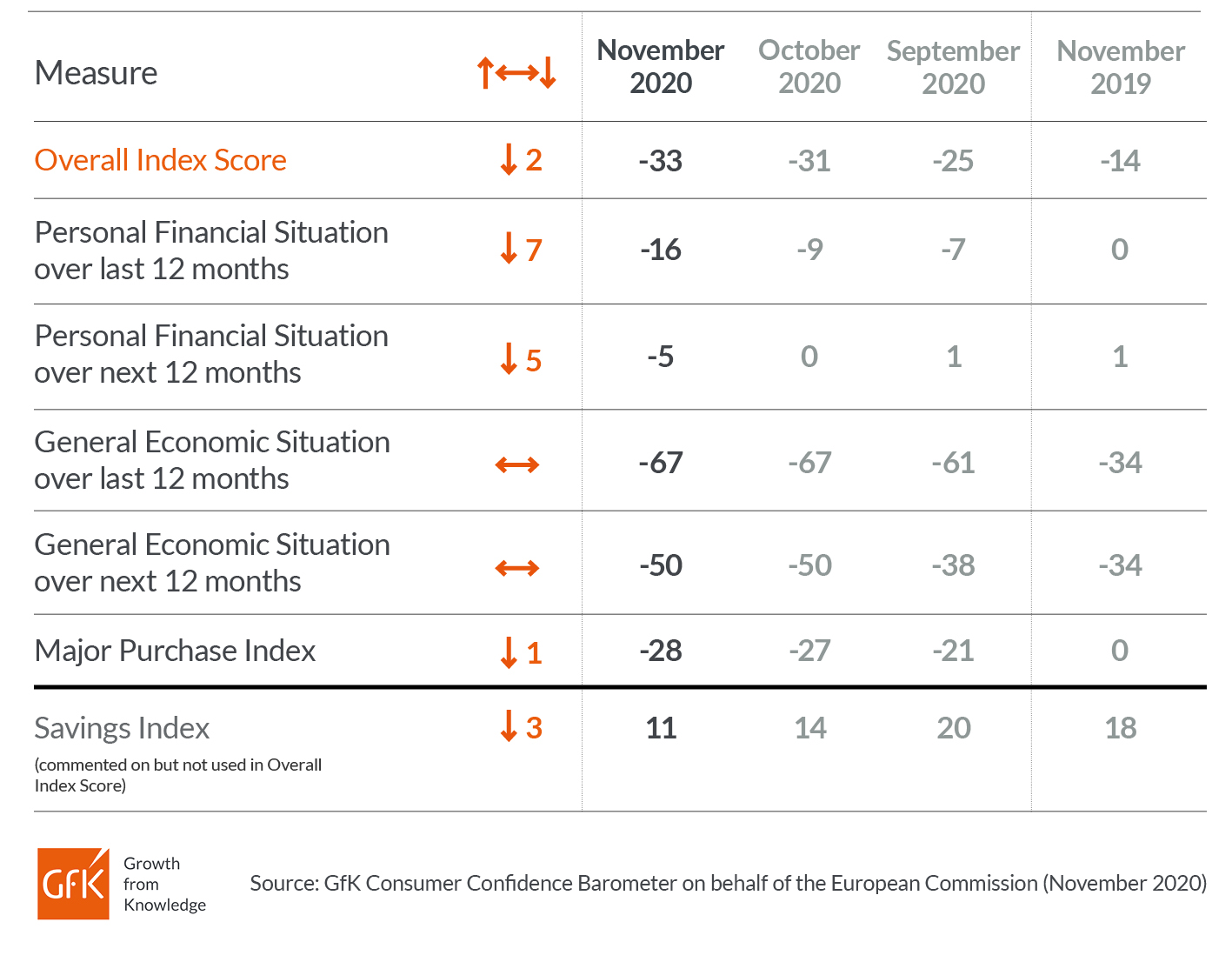

UK Consumer Confidence Measures – November 2020

The Overall Index Score decreased two points to -33 for November. Three measures decreased in comparison to the October 23rd announcement and two were unchanged.

Personal Financial Situation

The index measuring changes in personal finances over the last 12 months is down seven points to -16; this is 16 points lower than November 2019.

The forecast for personal finances over the next 12 months is down five points this month at -5; this is six points lower than November 2019.

General Economic Situation

The measure for the general economic situation of the country during the last 12 months is unchanged at -67; this is 33 points lower than in November 2019.

Expectations for the general economic situation over the coming 12 months are also the same as last month at -50; this is 16 points lower than November 2019.

Major Purchase Index

The Major Purchase Index has decreased by one point to -28 in November; this is 28 points lower than it was in November 2019.

Savings Index

The Savings Index has dropped three points to +11 in November; this is seven points lower than this time last year.

Download the full set of charts for GfK Consumer Confidence UK - November 2020

----

About the survey

- The UK Consumer Confidence Barometer is conducted by GfK on behalf of the EU, with similar surveys being conducted in each European country. In producing its own reports on the whole of Europe, the EU applies a seasonal adjustment to the data, to smooth out any changes that are functions, at least in part, of the time of year.

- Historically, the UK data have not been seasonally adjusted in this way, and to maintain comparability, GfK continues not to apply this adjustment. This can lead to situations where the EU figures show different movements in a particular month from those produced by GfK. Individual months may be affected, but the long-term trend is not.

- This month’s survey was conducted among a sample of 2,000 individuals aged 16+ on behalf of the European Commission.

- Quotas are imposed on age, sex, region and social class to ensure the final sample is representative of the UK population.

- Interviewing was carried out between 2nd November and 13th November 2020.

- The figures contained within the Consumer Confidence Barometer have an estimated margin of error of +/-2%.

- The Overall Index Score is calculated using underlying data that runs to two decimal points.

- The confirmed date of the remaining press release in 2020 is December 18th. The first three confirmed dates for 2021 are: January 22nd, February 19th and March 19th.

- Any published material requires a reference to both GfK and the European Commission e.g. ‘Research carried out by GfK on behalf of the European Commission’.

- This study has been running since 1974. Back data is available from 2006.

- The table below is an overview of the questions asked to obtain the individual index measures:

Personal Financial Situation

(Q1/Q2)

|

This index is based on the following questions to consumers: ‘How has the financial situation of your household changed over the last 12 months?’

‘How do you expect the financial position of your household to change over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse)

|

|

General Economic Situation

(Q3/Q4)

|

This index is based on the following questions to consumers: ‘How do you think the general economic situation in this country has changed over the last 12 months?’

‘How do you expect the general economic situation in this country to develop over the next 12 months?’

(a lot better – a little better – stay(ed) the same – a little worse - a lot worse)

|

|

Major Purchase Index

(Q8)

|

This index is based on the following question to consumers: ‘In view of the general economic situation, do you think now is the right time for people to make major purchases such as furniture or electrical goods?’

(right time – neither right nor wrong time – wrong time)

|

|

Savings

Index

(Q10)

|

This index is based on the following question to consumers: ‘In view of the general economic situation do you think now is?’ (a very good time to save – a fairly good time to save – not a good time to save – a very bad time to save)

(Commented on but not included in the Index Score)

|