London,

19.11.2021

UK Consumer Confidence creeps up in November despite high inflation

Seven-point jump in major purchase index is good news for retailers in run-up to Black Friday and Christmas

GfK’s long-running Consumer Confidence Index increased three points to stand at -14 in November. Four measures were up, and one was down in comparison to the October 22nd announcement.

Joe Staton, Client Strategy Director GfK, comments: “Headline consumer sentiment has ticked upwards this month despite decade-high inflation, fears of higher prices and worries over rising interest rates, and as the deepening cost-of-living squeeze leaves UK household finances worse off this winter.

"The view on the general economic situation over the past year and year to come is better this month (up six points and three points respectively) but consumers are slightly less buoyant on their personal finances. This weakness is important as it reflects day-to-day plans to save or spend and is a strong driver of overall UK economic growth.

"However, one highlight for both physical and virtual retail is the seven-point jump in major purchase intentions in the run-up to Black Friday and Christmas. Is this a sign that shoppers are ready to bounce back, after last year’s cancelled family gatherings, with a Christmas splurge in coming weeks? That’s how it looks - but consumers also know that when the festivities are over it’s going to be a tough year in 2022.”

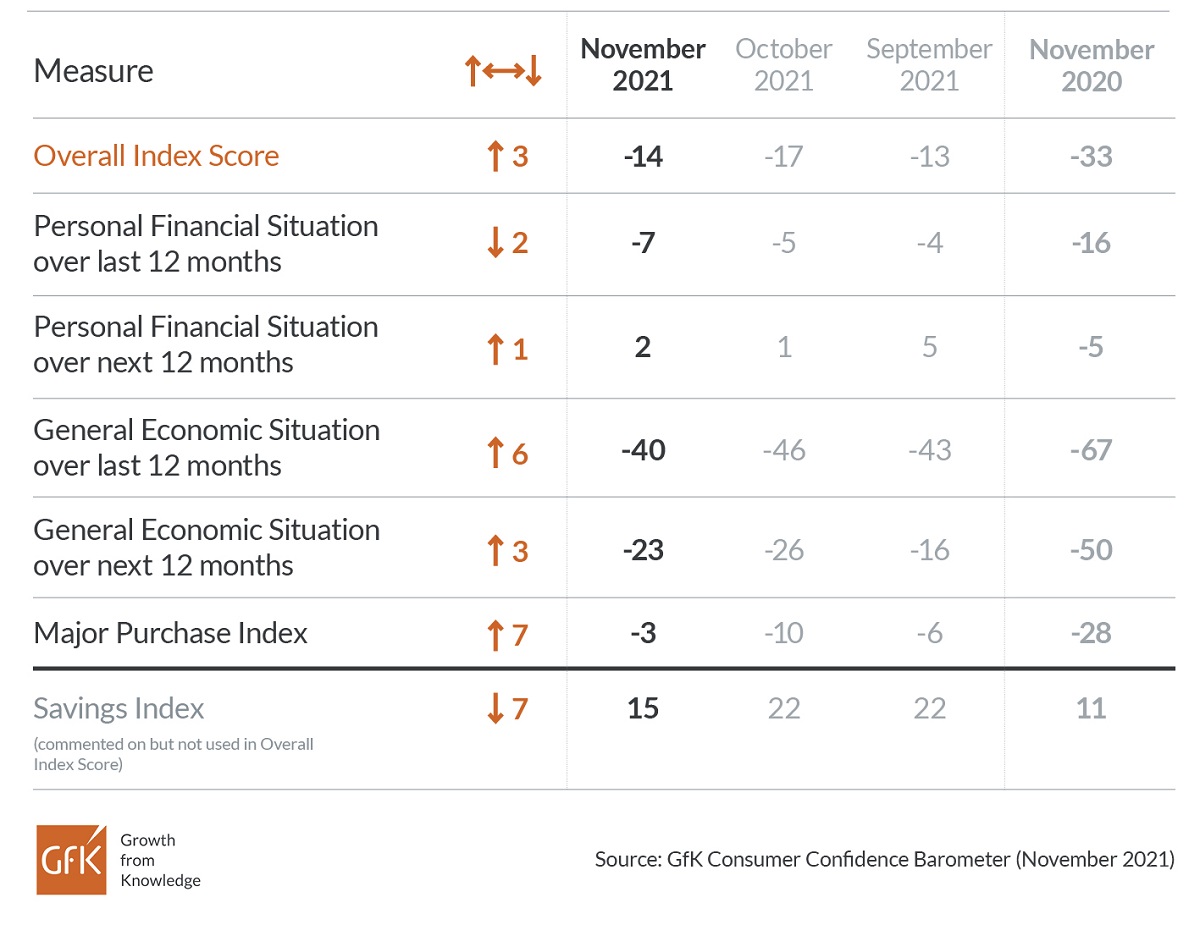

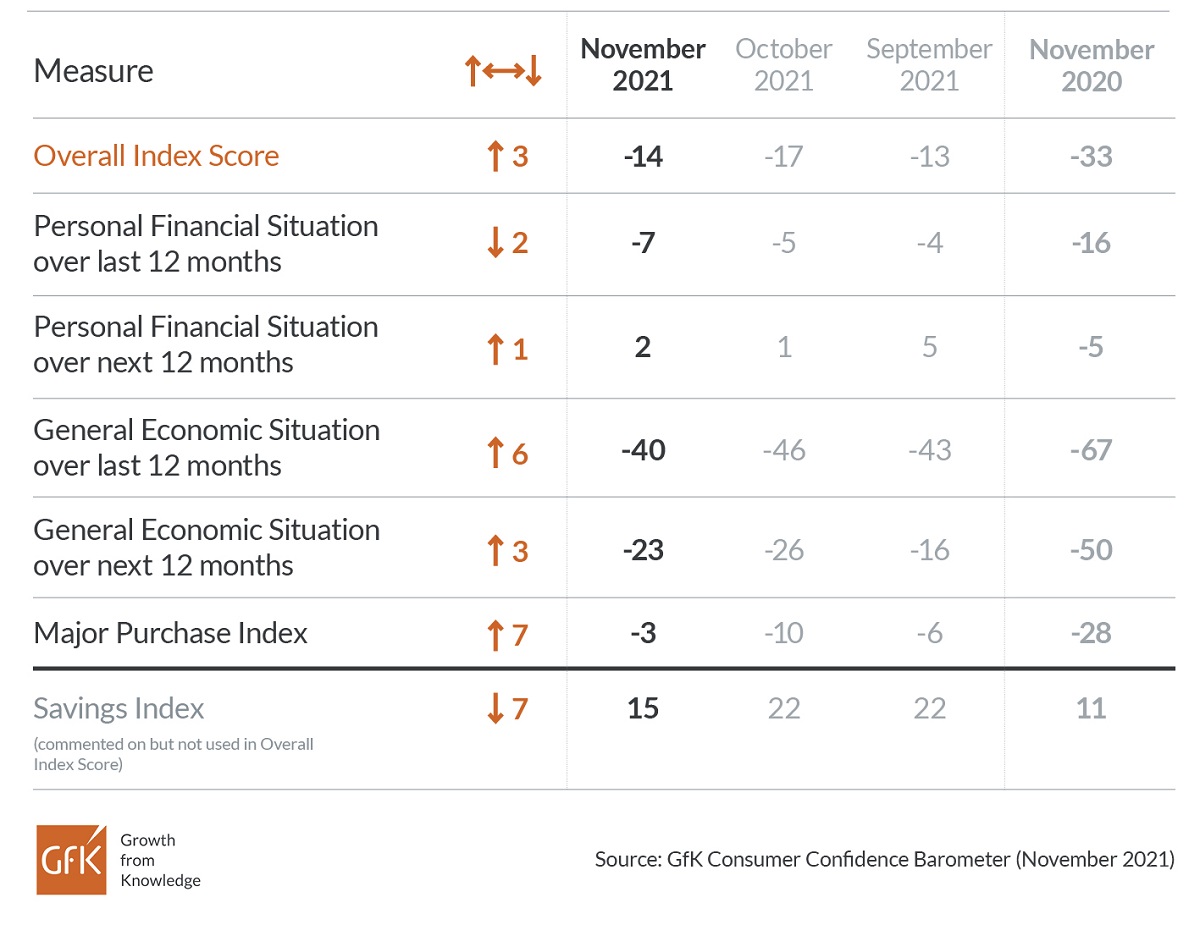

UK Consumer Confidence Measures – November 2021

The Overall Index Score increased three points to -14 in November. Four measures were up, and one was down in comparison to the October 22nd announcement.

Personal Financial Situation

The index measuring changes in personal finances over the last 12 months has dropped two points to -7; this is nine points better than November 2020.

The forecast for personal finances over the next 12 months has increased one point to +2; this is seven points higher than this time last year.

General Economic Situation

The measure for the general economic situation of the country during the last 12 months is six points better at -40; this is 27 points higher than in November 2020.

Expectations for the general economic situation over the coming 12 months have improved by three points to -23; this is 27 points higher than November 2020.

Major Purchase Index

The Major Purchase Index has increased by seven points to -3 in November; this is 25 points higher than it was this month last year.

Savings Index

The Savings Index has weakened by seven points to +15 in November; this is four points higher than this time last year.

About the survey

- The UK Consumer Confidence Barometer is conducted by GfK.

- This month’s survey was conducted among a sample of 2,000 individuals aged 16+.

- Quotas are imposed on age, sex, region and social class to ensure the final sample is representative of the UK population.

- Interviewing was carried out between November 1st and November 12th.

- The figures contained within the Consumer Confidence Barometer have an estimated margin of error of +/-2%.

- The Overall Index Score is calculated using underlying data that runs to two decimal points.

- The confirmed date of the next press release is December 17th 2021. The dates for the first half of next year are: January 21st 2022; February 25th 2022; March 25th 2022; April 22nd 2022; May 20th 2022; and June 24th

- Any published material requires a reference to GfK e.g. ‘Research carried out by GfK’.

- This study has been running since 1974. Back data is available from 2006.

- The table below is an overview of the questions asked to obtain the individual index measures:

Personal Financial Situation

(Q1/Q2)

|

This index is based on the following questions to consumers: ‘How has the financial situation of your household changed over the last 12 months?’

‘How do you expect the financial position of your household to change over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse)

|

|

General Economic Situation

(Q3/Q4)

|

This index is based on the following questions to consumers: ‘How do you think the general economic situation in this country has changed over the last 12 months?’

‘How do you expect the general economic situation in this country to develop over the next 12 months?’

(a lot better – a little better – stay(ed) the same – a little worse - a lot worse)

|

|

Major Purchase Index

(Q8)

|

This index is based on the following question to consumers: ‘In view of the general economic situation, do you think now is the right time for people to make major purchases such as furniture or electrical goods?’

(right time – neither right nor wrong time – wrong time)

|

|

Savings Index

(Q10)

|

This index is based on the following question to consumers: ‘In view of the general economic situation do you think now is?’ (a very good time to save – a fairly good time to save – not a good time to save – a very bad time to save)

(Commented on but not included in the Index Score)

|