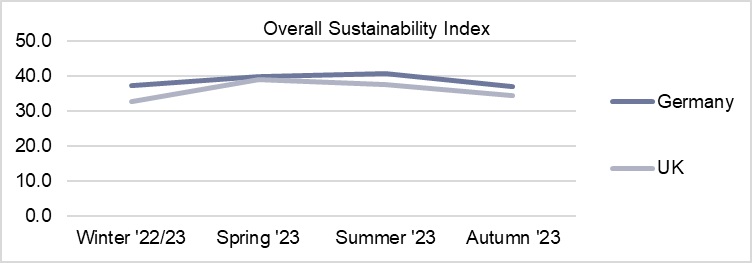

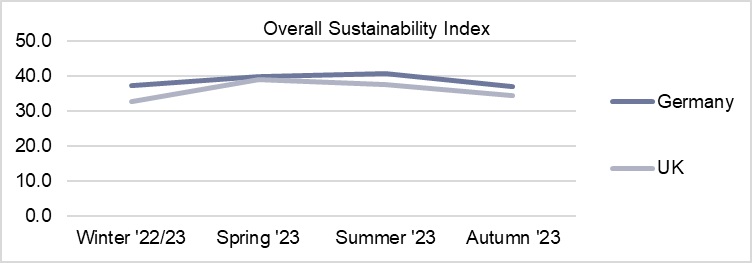

Shoppers’ propensity to make purchases that have sustainability in mind has increased in the UK and held steady at an already stronger level in Germany over the course of 2023.

UK shoppers’ sustainability index rating – Autumn 2023

UK shoppers started 2023 with an overall Sustainability Index rating of 32.7 (out of a possible 100). After a peak during the spring and summer surveys, that has now settled at 34.6 in the latest autumn results.

The Sustainability Index is a measure that combines three factors:

- shoppers’ actual purchases made in the last 12 months that took sustainability aspects into account,

- their planned purchases over the next 12 months that will take sustainability aspects into account

- and their willingness to pay more for those planned purchases if the items are made in a sustainable way.

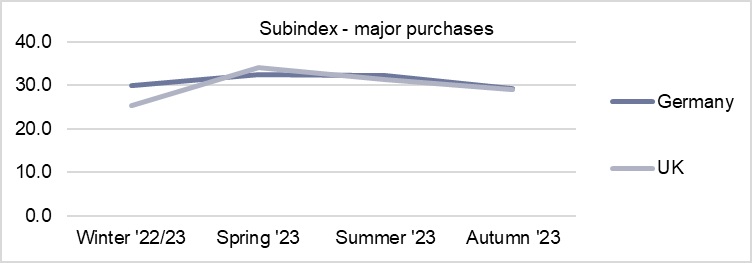

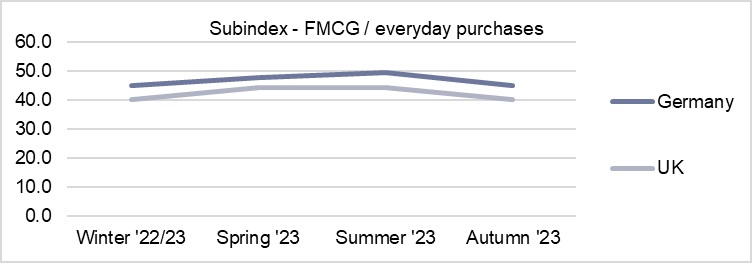

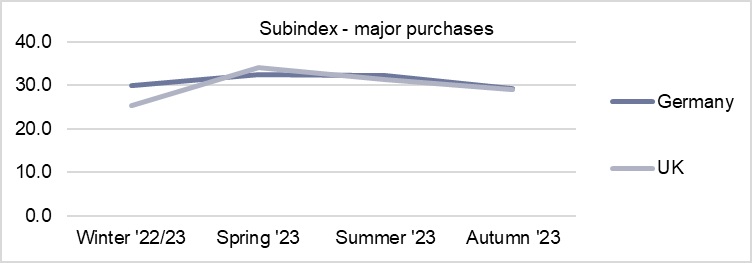

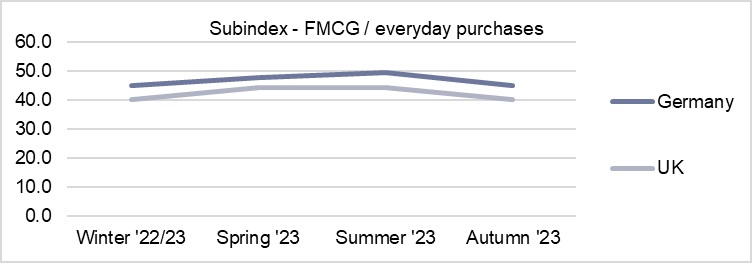

The index also breaks down this rating for two types of purchase – major items, such as major domestic appliances or vehicles, etc, and daily use items, such as groceries and FMCG.

For UK shoppers, their propensity to take sustainability factors into account for major item purchases has jumped from 25.3 at the start of the year to 28.9 now. For everyday purchases, this propensity started higher – at 40.0 in January – and has held steady at that level, currently standing at 40.2.

German shoppers’ sustainability index rating – Autumn 2023

Shoppers in Germany show a sightly higher propensity than in the UK to take sustainability factors into account across their purchases.

At the start of the year, the overall sustainability index rating in Germany was 37.4; slightly higher than UK shoppers. There was a slight rise over the spring and summer, although not as sharp as the rise seen in the UK, before settling back to 37.2 in the latest autumn survey.

When it comes to major purchases, Germany’s shoppers have held pretty steady – starting the year at 30.0 and falling only slightly to 29.3 now. For everyday purchases, there is also a steady landscape, rising slightly from 44.8 in January to 45.0 now.

GfK’s Sustainability Index – Autumn 2023 – Germany and UK

Source: GfK Sustainability Index | Autumn 2023

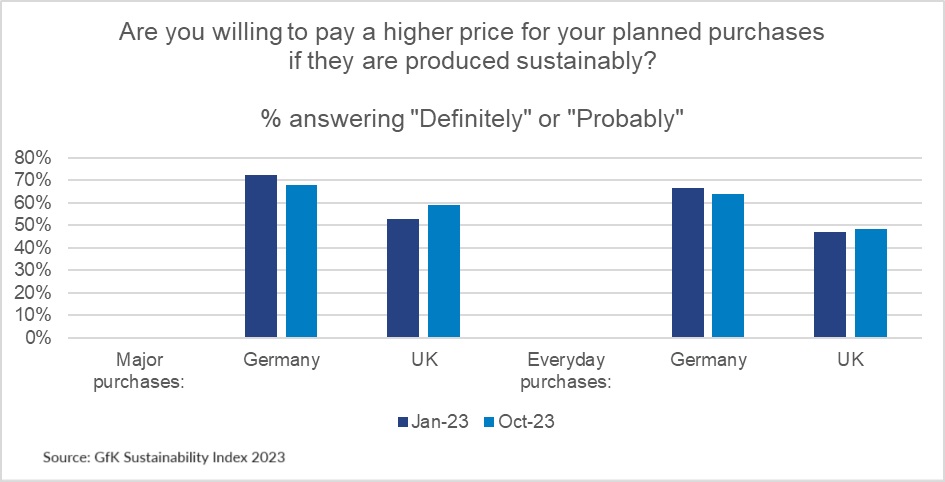

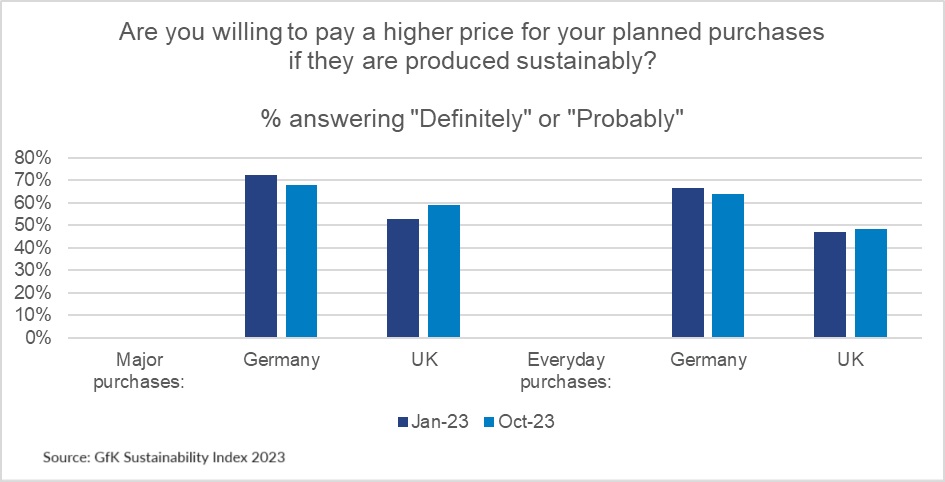

Willingness to pay more if items are produced sustainably.

In the UK, a little under two thirds (59.0%) of shoppers today say they are willing to pay more for the major purchases they plan to make in the next 12 months, if the product is produced in a sustainable way – and nearly half (48.4%) say the same for their everyday purchases. That is up on both counts since the start of this year.

In Germany the picture is slightly different. Here, a greater percentage say they are willing to pay more – 68.1% for planned major purchases, and 64.1% for everyday purchases – but this has fallen slightly since the start of the year.

Brands can focus their strategy around two key areas that support shoppers’ eco-spending intentions:

1. Trust in eco-credentials

When it comes to values-based purchase, consumers’ expectations are expanding. In Germany, only 20% of people believe the claims that companies make about their environmentally friendly activities.

To break through this scepticism around ‘greenwashing’, brands must communicate a full-spectrum eco focus that incorporates everything from the suppliers they work with; to their products’ material, packaging, transportation, durability, recyclability, as well as their brands’ support of environmental or humanitarian causes.

This is a natural expansion of what we are already seeing at product level. In the EU5’s highly competitive smartphone, mobile and phablet market two-thirds of sales revenue in H1 this year came from products that have 3 or more eco-claims. With a growth rate of +22%, these items are substantially out-performing products that are making only 1 or 2 eco-claims.

2. “Affordable premium”

For big-ticket purchases in particular, consumers are operating within a budget, but are likely to seek out the highest value replacements they can afford within that. Consumer tech & durables manufacturers and retailers can help drive interest in ‘affordable premium’ range products by marketing that highlights the additional functions and features, alongside promotion of the long-term money saving enabled by 'product lifetime cost’ features such as energy efficiency, durability and repair-ability.

Keep exploring how environmental concerns influence consumer attitudes and buying behaviors: