Each year, the scientific evidence of global warming and environmental degradation becomes more stark. The need for rapid action is urgent – whether that’s cutting emissions, reducing waste, or conserving ecosystems. These existential issues are paramount, but there is a growing business imperative to act sustainably too. In the long run, markets cannot thrive without the stable, productive economies that climate change puts at risk, while in the near term, consumers are demanding sustainable retail.

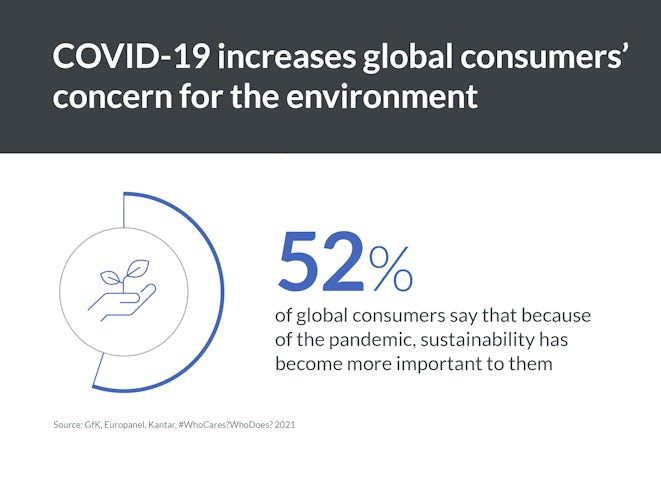

The COVID-19 pandemic has acted as a catalyst for consumers’ concern about environmental issues. Data from GfK’s third edition of the Who Cares? Who Does? report demonstrates this – 52% of shoppers globally say that sustainability has become more or much more important to them because of the pandemic. United under a single international disaster, consumers have become more aware of the global connection between nature and their economic and social realities, and increasing numbers of shoppers are understanding the impact their buying has on the environment.

The growing business opportunity, and the value action gap

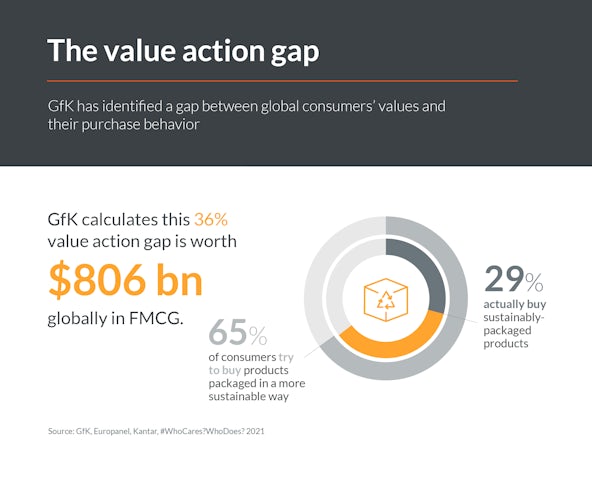

This large-scale shift in consumer attitudes presents a challenge for businesses, but also an opportunity for those bold enough to rise to the challenge. An increasing number of consumers in fast-moving consumer goods (FMCG) and broader retail are making green issues a key driver of their purchase decisions. Satisfying this demand for sustainable retail will reap rewards, but beyond this trend, GfK has identified a more complex dynamic – an observable disconnect between how consumers want to buy, and how they actually buy.

This discrepancy between consumers’ values and their actions represents unfulfilled green intentions. It means consumers want to play their part in a sustainable future, but either don’t know how or feel that doing so is too difficult. Brands that can help them buy as they want to can tap into significant spending power.

This value action gap can be seen in attitudes around packaging. GfK research shows that 65% of global consumers try to buy products that are packaged more sustainably, but only 29% regularly avoid plastic packaging – it also shows that product packaging is one of the most important factors that green consumers consider when they try to buy sustainably. In fact, this 36% of consumers is worth $806bn of untapped FMCG market opportunity. These consumers want to purchase environmentally friendly products and services, but encounter a variety of barriers that prevent them from acting on this desire. Brands that understand how to remove these barriers to sustainable retail behavior can close the value action gap, unlocking valuable revenue streams in the process.

Understanding today’s green consumer

To harness soaring sustainable spending power and close the value action gap, brands must first understand shoppers’ varying environmental attitudes and actions. The Who Cares? Who Does? study, created in collaboration with Europanel and Kantar, reveals that when it comes to environmental concerns, climate change ranks first for consumers – a new entry at top spot since the pandemic – followed by water pollution, and then plastic waste. GfK has defined three consumer segments based on both their level of concern for environmental issues, and their levels of sustainable retail activity. The segments are Eco-actives, Eco-considerers, and Eco-dismissers.

These green consumers are the most conscientious, taking action to reduce their waste, and feeling an intrinsic responsibility to be more sustainable. Of each segment, they have the greatest awareness of environmental issues. Eco-actives are particularly prevalent in Europe, where they made up 18% of the population in 2019, rising to 28% in 2021. They are also the fastest-growing group globally, currently accounting for 22% of consumers. By 2029 they are projected to make up over 50% of the entire global population.

Concern for environmental issues is often associated with the young, but older shoppers also make up a significant proportion of Eco-actives, thanks to their greater spending power. In Europe, Eco-actives tend to be over 50, with higher income and social status, while in developing economies, the shoppers who take the lead are usually younger. The number of Eco-actives is also rising quicker in developed economies. In developing nations, it may take until 2035 for Eco-actives to account for 50% of the population. Still, Eco-actives represent an immediate opportunity: right now, they are worth $446bn in FMCG spend, and that value is projected to reach $1.104tn by 2029.

The Eco-considerer segment comprises people who worry about the environment, but don’t take as much action to reduce their footprint as they would like to. At the time of writing, Eco-considerers account for the largest segment of the market. In Europe alone, they represent 44% of consumers, while the other two groups comprise 28% each. The value action gap is most pronounced among Eco-considerers, with 62% globally believing sustainable brands and products are harder to find or more expensive.

Price and findability aren’t the only barriers Eco-considerers find to purchasing as they want to: 44% say their day-to-day priorities get in the way, and 37% say they get distracted when shopping. By understanding and then removing these barriers, brands can access the segment’s untapped potential. Eco-considerers want to make the step to become Eco-actives, it is up to brands to show them how, and to make doing so easy.

Eco-dismissers are the least engaged segment in the study, taking little or no interest in the environment and making few steps to reduce waste. The topic rarely features in conversation with friends and family. The segment is defined by a low sense of personal agency on environmental issues: 39% of Eco-dismissers say they “feel I can make a difference to the world around me through the choices I make and the actions I take,” while 80% of Eco-actives share this belief.

Brands that have so far witnessed little sustainable retail purchase behavior from their consumers should be aware this group is shrinking. Eco-dismissers were equal in number to the Eco-considerers in Europe in 2019, both making up 41% of the global population, but in the last two years, their numbers have declined. In 2020 they accounted for 34% of the world’s consumers, and in 2021, the proportion had slimmed further to 28%.

Uncovering the barriers to sustainable shopping

Before uncovering barriers to sustainable retail can be an effective strategy, brands in FMCG and beyond must first ensure that their products and services are genuinely sustainable – green consumers are quick to spot and punish hollow greenwashing. The next step is removing barriers that prevent consumers from buying as sustainably as they’d like to, and to do so, brands must identify what these barriers are. GfK has pinpointed four of the main obstacles shoppers experience when trying to make green purchase decisions.

- Affordability – The most common barrier to sustainable shopping is the price of green goods. These products are, or are seen to be, more expensive, so consumers struggle to see the value in the premium price. 53% of global consumers say that sustainable alternatives for many of the products they use are too expensive.

- Functionality – There is a persistent concern from global shoppers that green products are less effective than standard ones. 31% of consumers say the environmentally friendly alternatives for many of the products they use just don’t work as well.

- Findability – Environmentally-friendly products are not as accessible as unsustainable ones and are hard for consumers to find. 41% of global consumers can name only one brand that shows genuine concern for the environment. Stepping into a supermarket involves thousands of micro-decisions. For each of these decisions the consumer has to invest energy to find the sustainable option. Choosing green can get drowned out in the tide of deals, discounts, and shouting brands.

- Distraction – Shoppers report they get distracted by other things when in the supermarket, with 37% of Eco-considerers sharing this view. Therefore, the onus is on retailers to design and configure spaces that don’t contain a dizzying array of options for consumers, making choosing sustainable retail a smooth, convenient, and recurring part of each shopping trip.

Four strategies to unlock unfulfilled sustainable demand

Despite the prevalence of these barriers, the news is good for sustainable retailers and eco-conscious brands: the consumer landscape is primed with unfulfilled demand. Consumers want green products, so to close the value action gap, brands should consider four strategies to unlock the $806 billion worth of opportunity with those consumers that want to purchase sustainably, but currently don’t.

- Increase perceived value – Brands need to increase the perceived value of sustainable products in the minds of consumers by demonstrating how the products actually offer consumers more, with broader benefits so they feel they are getting products with added value. This approach will help to attract Eco-dismissers, who may choose a sustainable product if it carries other benefits, like reducing their energy or water use.

In Germany, a market with one of the highest proportions of Eco-actives, lifestyle brands that have sustainability as one element of a broader value proposition outgrow the market, achieving growth at nearly double the rate of 'regular' brands. Telling compelling brand and product stories around sustainability makes products desirable at a time where a green lifestyle increasingly confers social status. Exhibit the green effects of purchasing a product to make doing so more rewarding for consumers, and justify higher price points. - Emphasize product effectiveness – Brands should focus on communicating the quality and functionality of their products. This will reassure Eco-dismissers who may harbor doubts about green products’ effectiveness, but even for Eco-considerers and Eco-actives, an inferior sustainable product will struggle to succeed in competition with superior, unsustainable equivalents. Where possible, brands should tell simple, engaging stories around product effectiveness and quality. Messaging is therefore key, but other strategies include customer testimonials, external certification, and even product awards.

- Make sustainability readily available – Sustainable retail needs to become convenient by being readily accessible in both the physical and digital sales channels that consumers are already using. Given the importance of convenience and findability when it comes to closing the value action gap, businesses must double down their efforts to make the retail experience that accompanies sustainable consumption as seamless and enjoyable as possible. Successful innovation here, whether through click-and-mortar, cross-reality shopping, direct-to-consumer models, social commerce, or more effective e-commerce, will, when combined with environmentally-friendly products, prove a potent way to remove barriers to sustainable shopping.

One of the features of the current market for green goods is that it’s made up of a multitude of single players – brands touting their own sustainable credentials, often very effectively, but without coordination. Consumers still have to work to find them. One potential solution is multiplayer partnerships between brands and retailers to make sustainable products easily searchable. Given the rising demand for sustainable products, coordination of this kind, where possible, could reap significant rewards. - Integrate and communicate green credentials – Clear and compelling communication will help products stand out, empowering green consumers who want to find sustainable products. 37% of global consumers say that packaging shapes their behavior regarding the environment, so product features and benefits, including sustainable packaging and green credentials, need to be clear and easy to understand.

An Eco-considerer with a busy schedule is likely to choose a sustainable product if they don’t have to work hard to find it, or to use it, so practical ‘How To’ instructions around, for example, recyclability or reusability, will reduce the workload for consumers. Where brands can, they should incentivize consumers’ sustainable retail behavior.

Brands must harness data to access Eco-consumer spending power

This article has outlined strategies to close the value action gap, but questions still remain for individual brands: How is our consumer base divided between Eco-actives, Eco-considerers, and Eco-dismissers? What is the size and the cause of the value action gap in my market? What can we do to help our customer shop as sustainably as they want to? To answer these questions, high-quality, real-time data intelligence is indispensable. Brands that take this path can begin to access the $806bn contained within the value action gap.

Want to have insights into the future of sustainable purchase behavior?

FAQs

-

Who are today’s green consumers?Globally, shoppers are increasingly making sustainable purchase choices. This shift, which has largely been driven by increased public awareness of climate change and damage to ecosystems, has been accelerated by the COVID-19 pandemic. GfK has defined three consumer segments: Eco-actives, Eco-considerers, and Eco-dismissers. Eco-actives are particularly prevalent in developed economies, and will proactively seek out sustainable products. Eco-considerers want to shop more sustainably, but find the barriers to doing so hard to overcome, while Eco-dismissers are relatively uninterested in the relation between retail and the environment.

-

Are consumers willing to pay more for green products and services?Increasingly, consumers are prepared to pay more for sustainable goods. This applies particularly to Eco-actives, who have green considerations front of mind when making purchase desicions. Brands should be wary though, price is still a major consideration, even for sustainable shoppers, and an inferior sustainable product will struggle to succeed in competition with superior, unsustainable equivalents. 53% of global consumers say that sustainable alternatives for many of the products they use are too expensive.

-

What is FMCG?

FMCG stands for fast-moving consumer goods, and applies to relatively low-cost, non-durable goods such as food and medication. These goods have a high inventory turnover, and are often found in supermarkets, pharmacies, and convenience stores.