76% of CMOs and senior marketers interviewed across Europe as part of a new GfK study say their organization has grown strongly over the last 3 years – and 74% are confident that their organization will be stronger in 3 years’ time than they are right now.

The confidence in recent growth is strongest in the UK, where 80% of senior marketers say they have grown strongly in the last 3 years – followed by Germany (74%) and France (70%). However, confidence for the coming 3 years is led by Germany (80%), followed by the UK (72%) and France (66%).

|

|

“We have grown strongly over the last 3 years”

|

“I’m confident that we will be stronger in 3 years’ time than we are now”

|

|

Global average

|

73%

|

78%

|

|

Europe average

|

76%

|

74%

|

|

France

|

70%

|

66%

|

|

Germany

|

74%

|

80%

|

|

United Kingdom

|

80%

|

72%

|

Forward-thinking marketing leaders have every reason to be upbeat.

Leading-edge technology is elevating marketing teams’ customer-facing and back-office operations, with facilities such as real-time insights and prescriptive data analytics gaining traction as use cases proliferate.

Market leaders have adjusted by investing in digital-first activations and campaigns. This strategy builds closer connections with consumers in the virtual arenas they increasingly inhabit. It also offers better customer experiences that deliver long-term value. These can be further optimized through data insights and generative AI that underpin greater personalization and automation.

“Marketers are increasingly leading the charge towards data maturity, becoming ever more sophisticated in how data is used,” says Garcia Villanueva, CMO at NielsenIQ. “Advanced data capabilities that help organizations make better decisions to prepare for whatever comes next will be a key marker of success in the future.”

CMOs that can make the business case for adopting analytics and more innovative technology - and then make the most of it - will be in an enviable position. Those that can’t, will find themselves trapped in a cycle of reactive, short-term activity that erodes their margins and brand value over time.

“I see a massive correlation among CMOs that embrace technology and those that are optimists,” says Garcia Villanueva. “We’re also seeing companies better understand the need to strategically invest in their brand for long-term growth – and this extends to sustainability too. Purpose and the bottom-line are converging and this is a positive for marketers."

Two-thirds of marketing leaders in the Europe study say it’s easy to justify marketing investments

Most marketers show impressive confidence in their ability to justify marketing investments. In Europe, 66% say it is easy to make the case for funding – with confidence highest in the UK (74%), followed by Germany (62%) and France (54%).

|

|

“It’s easy for us to make the case for marketing investment in the current economic environment.”

|

|

Global average

|

65%

|

|

Europe average

|

66%

|

|

France

|

54%

|

|

Germany

|

62%

|

|

United Kingdom

|

74%

|

Marketing investment is increasingly dependent upon demonstrating ROI to decision-makers. Only by testing and learning to improve returns will they make a convincing argument for further investment.

“We’ve all seen the impact of recent disruption on business-wide operations. These market events can pose either a risk or an opportunity on an almost weekly basis,” adds Garcia Villaneuva. “Marketers need to build prescriptive, data-driven processes so that they can stay ahead of such events and capitalize.”

There is a general recognition among CMOs that they have a delicate balance to strike. They must defend their budgets and an obvious way to do that is by showing immediate returns from fast turnaround projects. But they must also be mindful of the importance of long-term investment in brand building.

Advanced data capabilities that help these CMOs make better decisions to prepare for whatever comes next will be a key marker of success in the future.

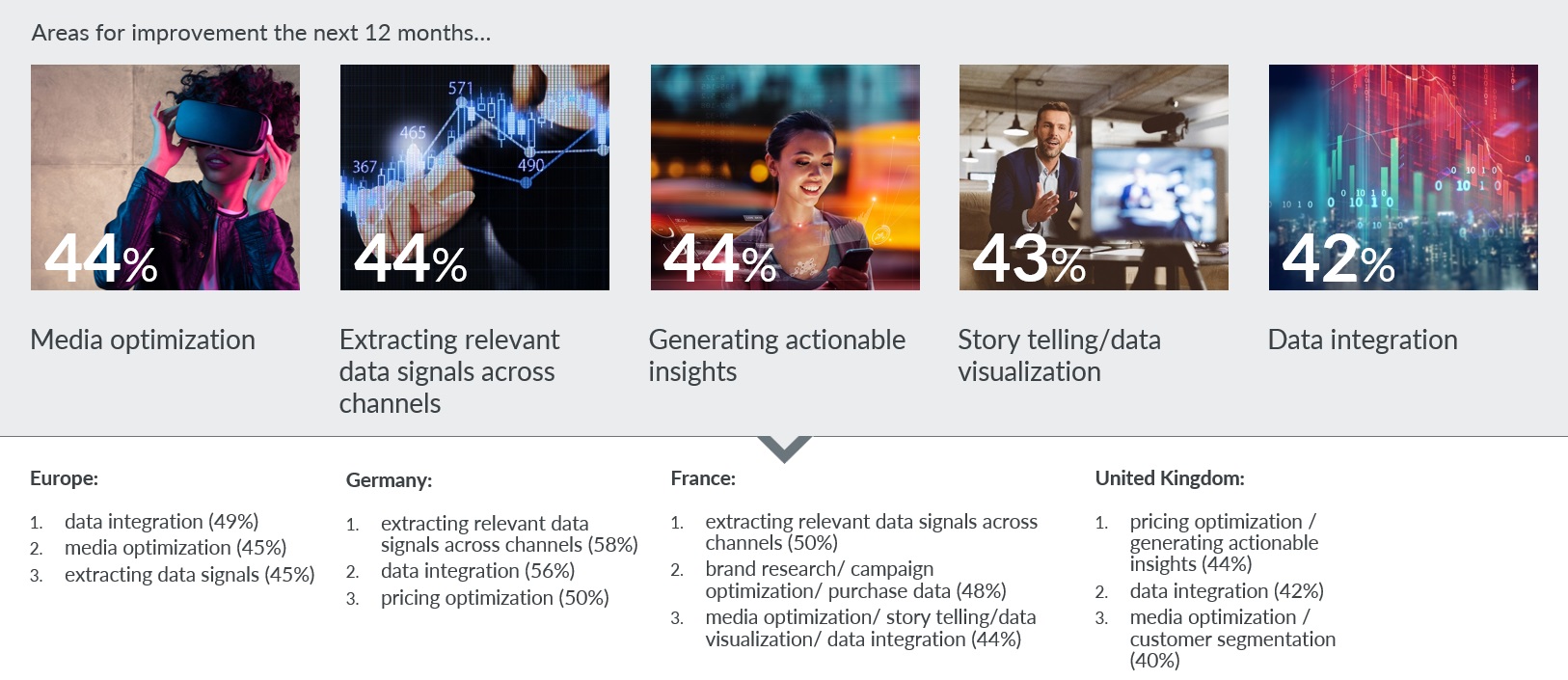

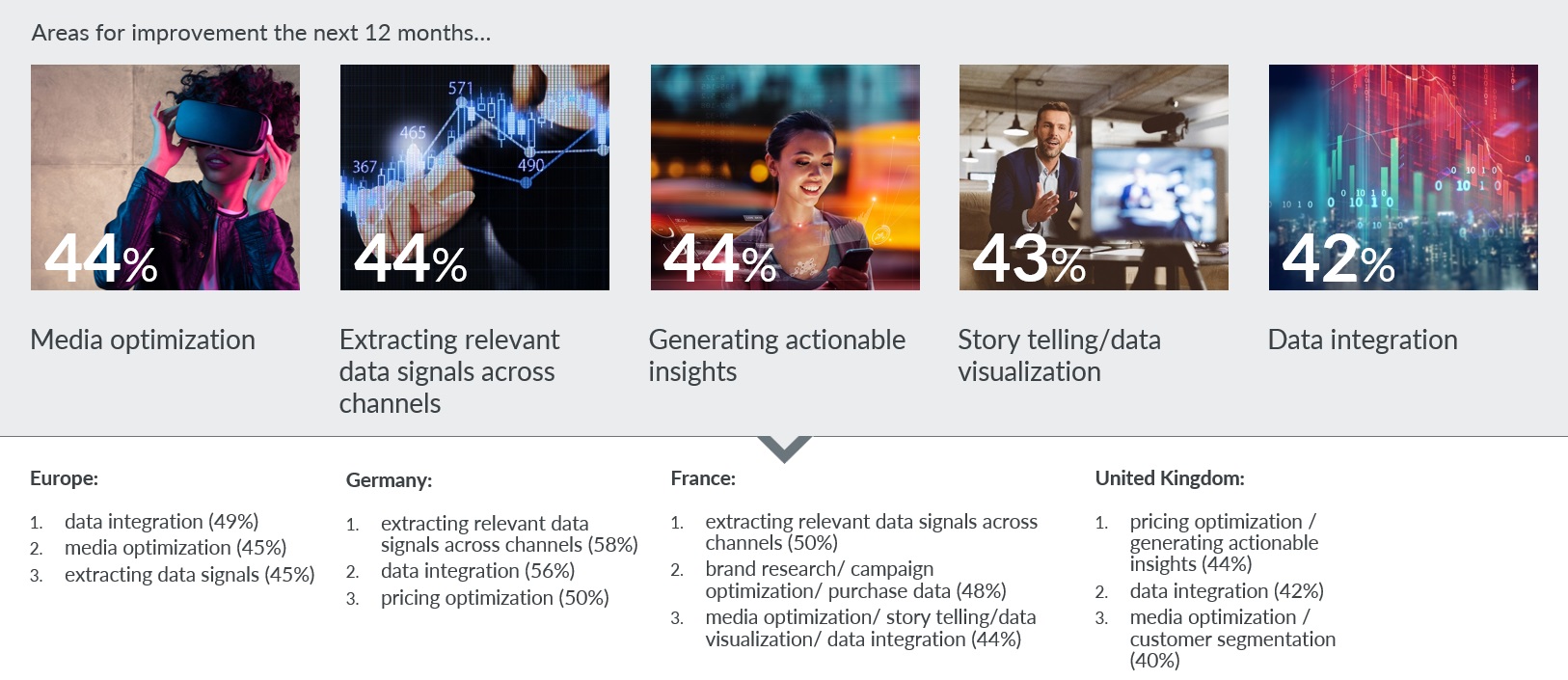

What's coming next...

Look out for our next article in this series, where we will delve into the areas identified by CMOs across Europe for improvement over next 12 months