Inside the Minds of the Cross Realities (XR) Consumer

Extended reality or XR (which broadly refers to AR, VR and MR, or Mixed Reality) is no longer confined to the realms of gamers and Gen Z. Accelerated by the pandemic, more and more brands across different industries are turning to augmented reality (AR) and virtual reality (VR) to enhance their experience, making XR consumers more common for people of all ages and genders.

Are we moving towards a cross-reality? Definitely. At the end of the day, XR consumers want technology to provide a new experience or dimension, as well as new solutions that make their life easier and problem-solving faster.

We spoke to Craig Melson, Head of Devices at techUK; Nick Fellingham, CEO of Condense Reality; and Tom Rockhill, Chief Commercial Officer at disguise, about what the typical XR consumer looks like, how this is changing, and where the opportunities lie for brands.

Who is the XR consumer?

The ‘typical’ XR consumer tends to be curious, experimental and forward-thinking on technology. They have a knowledge and passion for tech, an early-adopter nature, and are sometimes technology influencers. About half are millennials and nearly two-thirds are male.

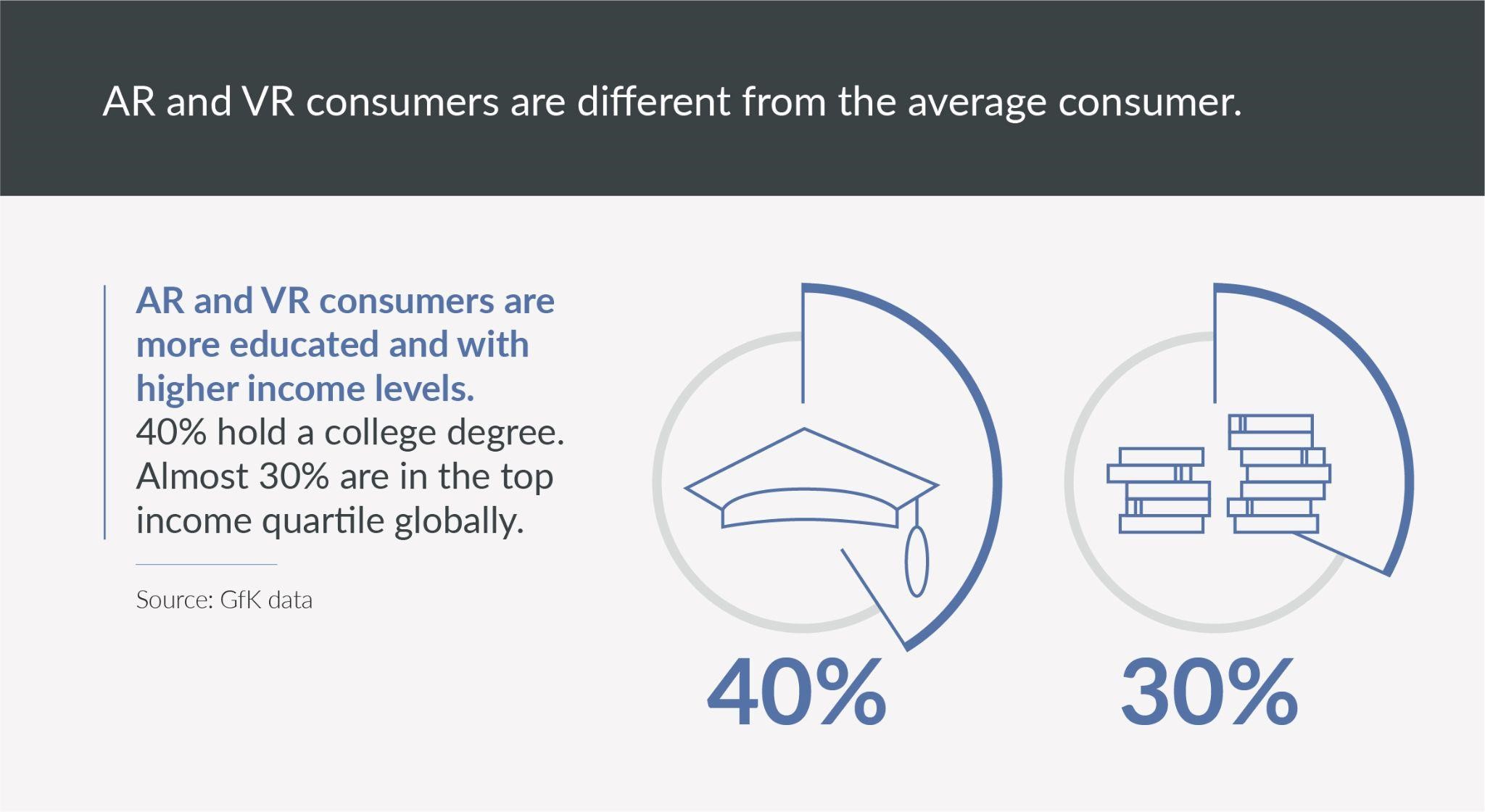

Similar to shoppers of new technologies like AR and VR, the typical XR consumer tends to be more educated and with higher income levels. VR headsets can be expensive and AR experiences often require users to have more advanced smartphones. About 40% hold a college degree and almost 30% are in the top income quartile globally.

These are definitely people who have a positive outlook on technology; they are not overly concerned with data privacy and they’re generally excited about seeing possibilities. This means XR consumers’ use and interest in VR and AR experiences is ‘more extensive’ than the average consumer.

But this profile is changing. The stay-at-home focus of 2020 has led brands to experiment with new ways to attract, engage and interact with XR consumers. And meant consumers looked for new ways to recreate physical experiences at home. The results of this cross-over are compelling. Shopify found that viewing 3D products in AR increases conversion rates by up to 250% and Papa John’s achieved a 25% conversion rate with an AR campaign.

Other brands that are stepping up include L’Oreal and Sephora, which use AR to enable XR customers to visualize what beauty products will look like. Furniture brands like IKEA use AR to help customers imagine what items will look like in their homes. And event companies such as LiveNation are using VR to bring live concerts right into the home.

As more brands across diverse industries turn to new tech to enhance the XR customer journey, it’s becoming more accessible and commonplace. This is broadening the profile of the typical XR consumer which has only been accelerated by the pandemic, which forced more people across all generations to take their daily lives online.

This is particularly true of the AR market, given it has much broader applications. AR experiences tend to be more accessible and don’t typically require users to change their behavior. VR on the other hand is currently more confined to the communications and entertainment sectors as users often need to wear goggles or headsets to access it.

While XR consumers are still mostly male as they ‘tend’ to buy more technology products, AR, in particular, is starting to be used by more women, says Craig Melson, Head of Devices at techUK. This may be in part due to its broad applications in retail.

How has the pandemic accelerated the XR industry?

“The pandemic has been really good in growing demand among XR consumers,” says Melson. “Take-up of XR has been high as people look for ways to keep sane and entertained.” In fact, the market size of XR consumers reached $18.8 billion last year, a three-fold increase from 2016, as brands and consumers looked for ways to bring the physical environment into their homes.

Before the pandemic, consumers often visited stores to view, touch, and feel products before buying them online. For 82% of consumers, this ability to see and feel a product before purchasing it on a digital platform was paramount.

At the same time, people's leisure time was often spent socializing with friends in a restaurant or cafe, going away on vacation, or heading to an entertainment venue such as a live concert or the cinema. But all this changed with the pandemic. For the first time, consumers couldn’t try on clothes in-store. They couldn’t attend live events or eat out in restaurants. Instead, they searched for ways to mimic these activities at home, prompting a surge in demand for AR and VR, with sales of headsets rising by 46% between January 2021 and June 2021, compared to the same period a year earlier.

“The restrictions in the pandemic meant that live experiences had to become virtual,” says Tom Rockhill, Chief Commercial Officer at disguise. XR consumers have shifted brands to host events and product launches while keeping people safe, at the same time as creating an experience that is global and not limited to local audiences. This combination of experience, safety and scalability is powerful.

Rockhill cites some examples. “Walmart and SAP used XR in their corporate conferences and annual investor meetings and Honda used it to create a live-streamed experience featuring Grammy award-winning artist H.E.R. when they launched their new 2022 Honda Civic Sedan.”

He notes that these events don’t have to be purely virtual, they can also have an in-person element making it a hybrid event. “Maserati’s MC20 two-day hybrid launch event used extended reality to unveil their new car to an online audience of over 27 million.”

In the retail and consumer goods sector, AR experiences help XR consumers to virtually ‘touch and feel’ products without having to venture into stores. Etsy customers can use AR to imagine how pictures and photographs will look on their walls. And AO.com, the e-commerce appliance seller, lets users virtually test whether appliances and electrical goods will fit into their rooms.

“In the AR market, retail has been solidly strong and growing,'' says Melson. AR engagement increased as much as 20% last year, with conversion rates for retailers swelling by as much as 90% for customers that engaged with AR. GfK data shows as many as 42.8% of global consumers want to use AR and VR to shop like they’re in a real store and 38.2% to experiment with new products, such as cars or paint colors, before buying them.

In the VR market, growth is likely to be for shorter experiences, such as entertainment or experiencing physical activities like sky-diving. GfK data shows that 56.6% of global XR consumers want it for watching movies, shows, and videos and 46.9% for visiting places such as travel destinations and museums.

Across both the VR market and AR market, education and enterprise-level training are areas of growth, according to Melson and Nick Fellingham, CEO of Condense Reality. “Remote, immersive communication and immersive experiences are in demand more than ever,” Fellingham notes. “People are bored of Zoom and excited for new ways to consume entertainment and learn.” Recognizing this shift, Zoom now enables users to collaborate in virtual workspaces.

XR consumers are an opportunity for brands

In retail and consumer goods, XR consumers have pushed brands to overcome barriers to sales, says Melson. By enabling XR consumers to imagine what products might look like in real life, XR supports people in making better, more informed purchase decisions, increasing the chances of a sale and reducing the likelihood of returns, he says.

Last year, about a third of customers used AR in shopping. Another 73% reported higher satisfaction, and 40% would pay more for a product if they could customize it in AR. For VR, 81% of people who experience it tell their friends and 13% say VR experiences will prompt them to shop more in physical stores.

In events and entertainment, XR consumers not only empower brands to deliver novel, immersive experiences to consumers at home but it also enables them to keep their teams safe, notes Rockhill. ASOS, the online fashion brand, uses VR to eliminate the need for models to come into their studio.

But unlocking the real potential of XR means making experiences as easy and seamless as possible to XR consumers, so they don’t think they’re doing anything different, says Melson.

For AR this means integrating it into applications and devices that they’re already using, he says, as retailers like Etsy are already doing. And in the VR market, the focus is on making experiences more comfortable and accessible, as headsets can be cumbersome to wear and cause motion sickness in some users, he notes.

At the same time, Melson and Rockhill emphasize the importance of applying XR to solve a real customer problem or need that exists today. “Brands need to build their toolset in line with customer needs,” Rockhill notes. “I advise having XR customer advisory boards and regular customer feedback calls, so customers can call attention to any problems and these can easily be addressed,” he suggests.

On a simpler level, Melson urges brands not to call it VR and AR. These terms in themselves can be daunting for consumers who aren’t familiar with what they mean and can simply cause people to turn away without engaging. For example, AR experiences that let people better visualize products or a VR video that immerses consumers in a new world, don’t need to be tagged as AR or VR - they’re just great new experiences for consumers.

Addressing concerns of the XR consumer of today and tomorrow

For many consumers, VR headsets in themselves are a deterrent. And as many as 27% of VR industry experts recognize this, claiming that user experience, such as bulky hardware, is an obstacle to its mass adoption.

“There are a lot of people who just don’t like it and don’t get on with it or feel well when using it,” says Melson. “Adoption can be seen as expensive or a gimmick but the biggest barrier is that people just don’t like it and feel ill.” For these people, VR is simply too immersive and triggers a visceral response, so AR can be a safer alternative with its lack of cumbersome headsets and the feeling of being more in control.

Other concerns include the cost of VR headsets and the quality of the content. “At the moment, VR is just being in a video that goes all the way around - it needs to have more obvious benefits,” Melson says. And according to GfK’s Panel Market Global Average Price, the cost of headsets is declining, so that it’s now possible to buy basic headsets for mobile phones for as little as 19 euros.

Across both the VR market and AR market, other top concerns are around data privacy and safety, with 61% of companies citing consumer privacy and data security as their primary concern, followed by product liability (49%) and health and safety issues (41%).

But consumer concerns and uptake vary widely by geography. China, for example, is leaps and bounds ahead of where the US or Western Europe is (which are more focused on data privacy). There is a willingness and a marketplace pushing it forwards, but what is holding it back in a lot of ways is Venture Capital investment and Government regulations with the concern on privacy issues.

What is the opportunity?

Imagine a future where customers no longer have to click-through pages of static product images. Instead, they can select a product type, then interactively click their way to achieve the perfect fit, color, and style. They could even try it on or see what it might look like in their home. Or perhaps you start selling a new, entirely virtual product line in virtual worlds. Given GfK data shows that 22.5% of global consumers plan to buy a standalone VR headset “in the next year or two”, this world is becoming entirely conceivable.

“As more start manufacturing this technology, the cost for it is set to go down in the near future,” says Rockhill. “This will empower more entities to start using technology for even more applications,” he says. For example, it can be a powerful teaching tool for students. “As the technology gets democratized, it will hopefully become a standard part of any type of experience, whether it is a brand experience, a performance or even an educational class.”

As the uses for XR broaden, so too does the type of XR consumer engaging with these experiences. Already 61% of consumers say they prefer retailers with AR experiences. And over two-thirds of marketers now expect to use AR and VR in the near future. Lorbach agrees that VR and AR can be valuable tools for supporting older generations in staying connected to loved ones and the outside world. And as 5G becomes more commonplace, accessing this type of content will be easier.

GfK’s latest Global Smartphone Market Trend report found adoption of 5G is becoming much more mainstream, particularly in China and developing Asia. Growth in sales of 5G smartphone units in China increased from 19% in the first quarter of 2020 to 82% in the second quarter of this year.

As XR becomes more commonplace, Rockhill believes an interesting new world will emerge that has the potential to change the way people–especially XR consumers–interact with brands forever.

“Most interesting is the concept of the metaverse: a digital twin of our world which will become a much larger platform in the future,” he says. “Using the metaverse, brands can provide more tailored, personalized, and meaningful experiences, as the nature of the metaverse is uniquely experienced by every individual user in their own digital universe. Bloomberg currently estimates that the metaverse is already worth $800 billion.”

Brands including Gucci and Balenciaga are already taking advantage and selling digital-only products and showcasing them in extended reality, Rockhill mentions. Fortnite, the online game, made over $9-billion in revenue in 2018-19 selling digital products and hosting digital, live performances using extended reality, he says. Fortnite players spend on average $85 on in-game purchases like cosmetics.

“Those that start developing these platforms will obviously have leverage over those who are left behind,” he says. “Much like how the internet and social media platforms changed our world in the early 2000s, the metaverse promises to do the same - and extended reality technology is powering it all.”

How your brand can tap into the XR consumer

For now, there are plenty of ways for brands to start tapping into the XR consumer market. For example, simple innovations like 3D content have been shown to increase conversions by as much as 28% on retailer websites. And existing virtual worlds like Fortnite and Roblox offer entry points for brands looking to engage younger generations such as Gen Z.

“My advice would be to show, not tell,” says Rockhill. “Once people see what this technology can do and how it can transport people into a whole new world, they will be converted,” he says. “I mean, imagine being able to bring to life an imaginary reality in real-time? This is not a science fiction movie, this is happening right now and it looks incredible.”

GfK predicts that as consumers become more comfortable with the technology and younger generations grow up compared to many of the recent tech skeptics, the next five years will bring far-reaching opportunities for brands when it comes to XR consumers - from retail and education to events and entertainment.

But unlocking this potential requires authentic brand building and a deep understanding of customers, their challenges, and motivations. By identifying specific use cases and creating applications that are easy to use, brands can familiarize consumers with XR, holding their hand as they transition towards a new cross reality.

Want to know more about the Cross Realities (XR) Consumer?

FAQs

What is XR?

XR or extended reality, is a catch-all term for virtual reality (VR), augmented reality (AR), and mixed reality (MR), which combines them both.

What is XR vs. AR?

XR is an umbrella term that includes AR or augmented reality. Augmented reality enhances the real-world environment through the use of digital visual elements, sound, and other sensory stimuli. It’s also often accessed via a smart device.

What is XR vs. VR?

XR is an umbrella term that includes VR or virtual reality. Virtual reality immerses users in an entirely virtual world and it’s accessed using a headset, and sometimes interactive hand controllers.

What is XR used for?

XR experiences such as AR and VR are used in a variety of applications and across a range of industries, including retail, health and fitness, entertainment, and education.

What is the difference between VR and AR?

AR takes the physical environment and enhances it and it’s often accessed via a smart device such as a smartphone or tablet. On the other hand, VR immerses users in an entirely virtual world and is accessed by wearing a headset and can include interactive hand controllers.

Related Posts

Consumer Insights

How brands can embrace premiumization to outpace deceleration

3 MIN READ

Consumer Trends

How to leverage the consumer trends driving the success of 618 and Prime Day

4 MIN READ