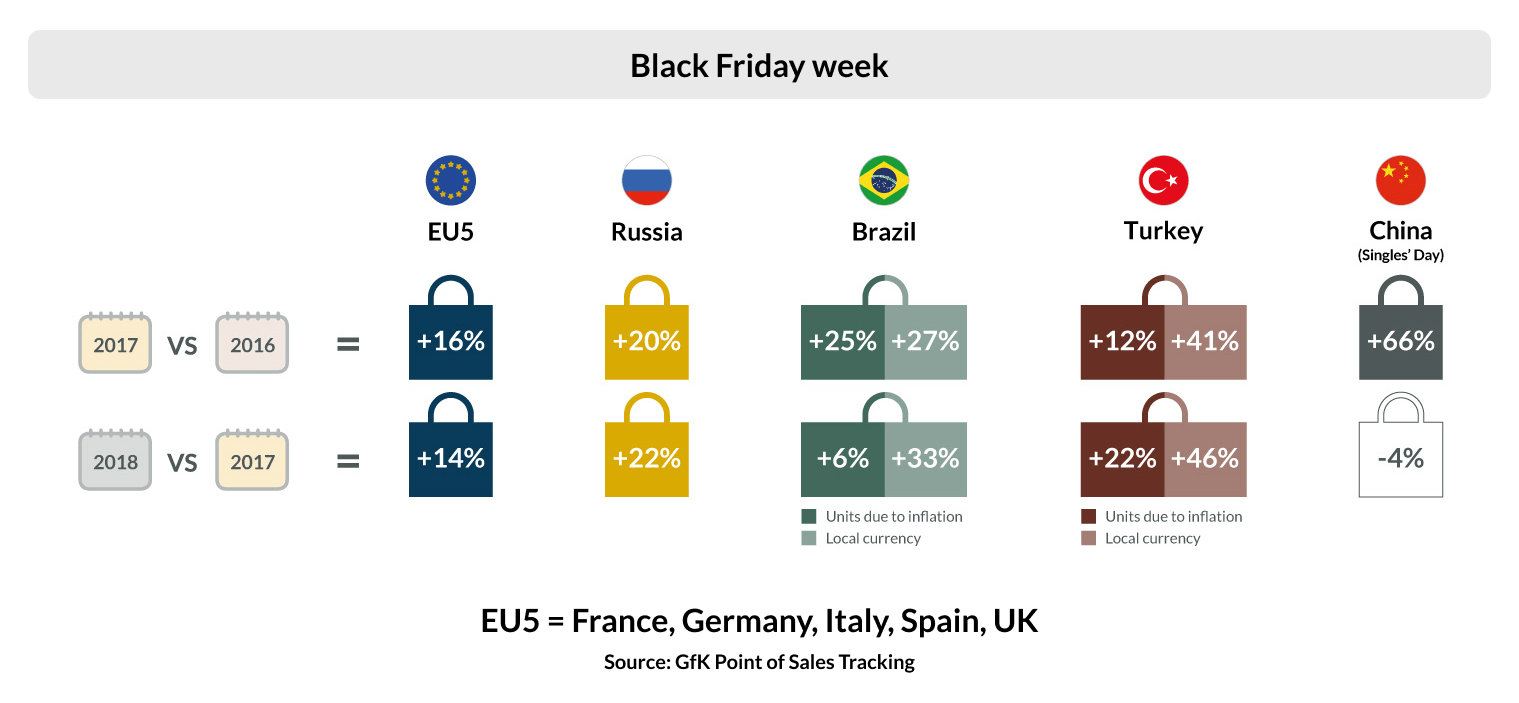

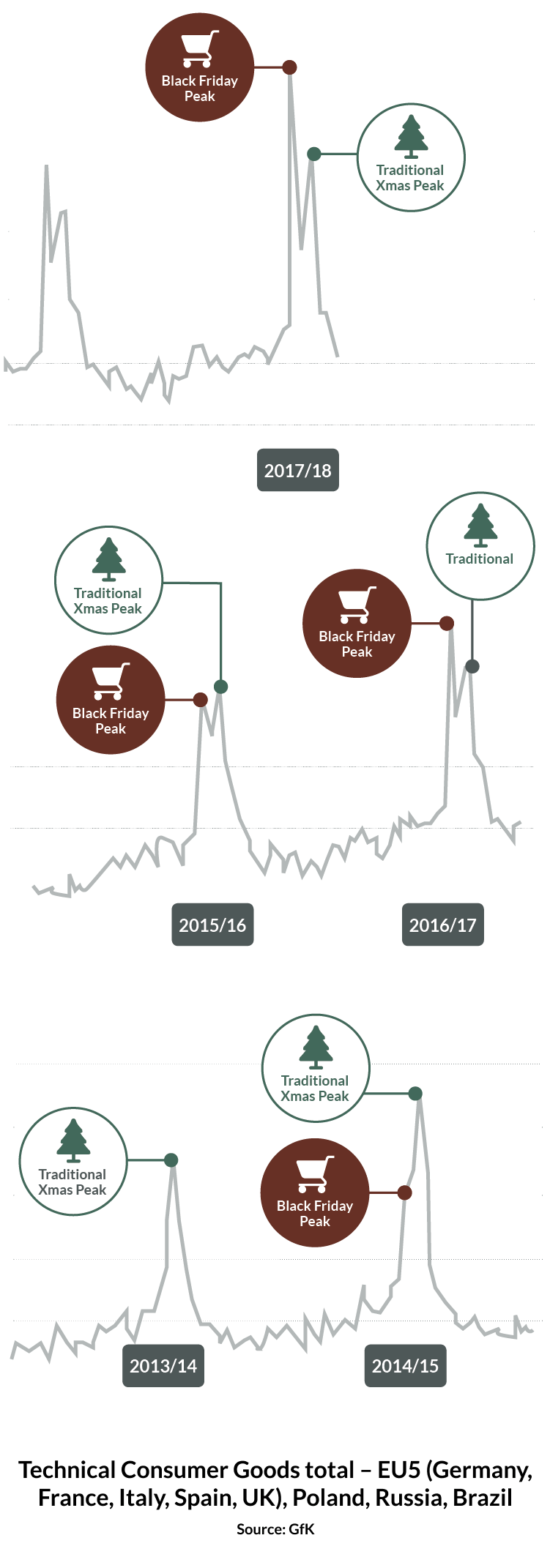

Seasonal November promotions like Singles’ Day (11.11) in China and Black Friday in many markets around the world are deeply embedded in the retail calendar. These events continue to grow strongly across many of our monitored countries, with only the early adopter countries of China and UK showing value decreases in 2018 after several years of growth.

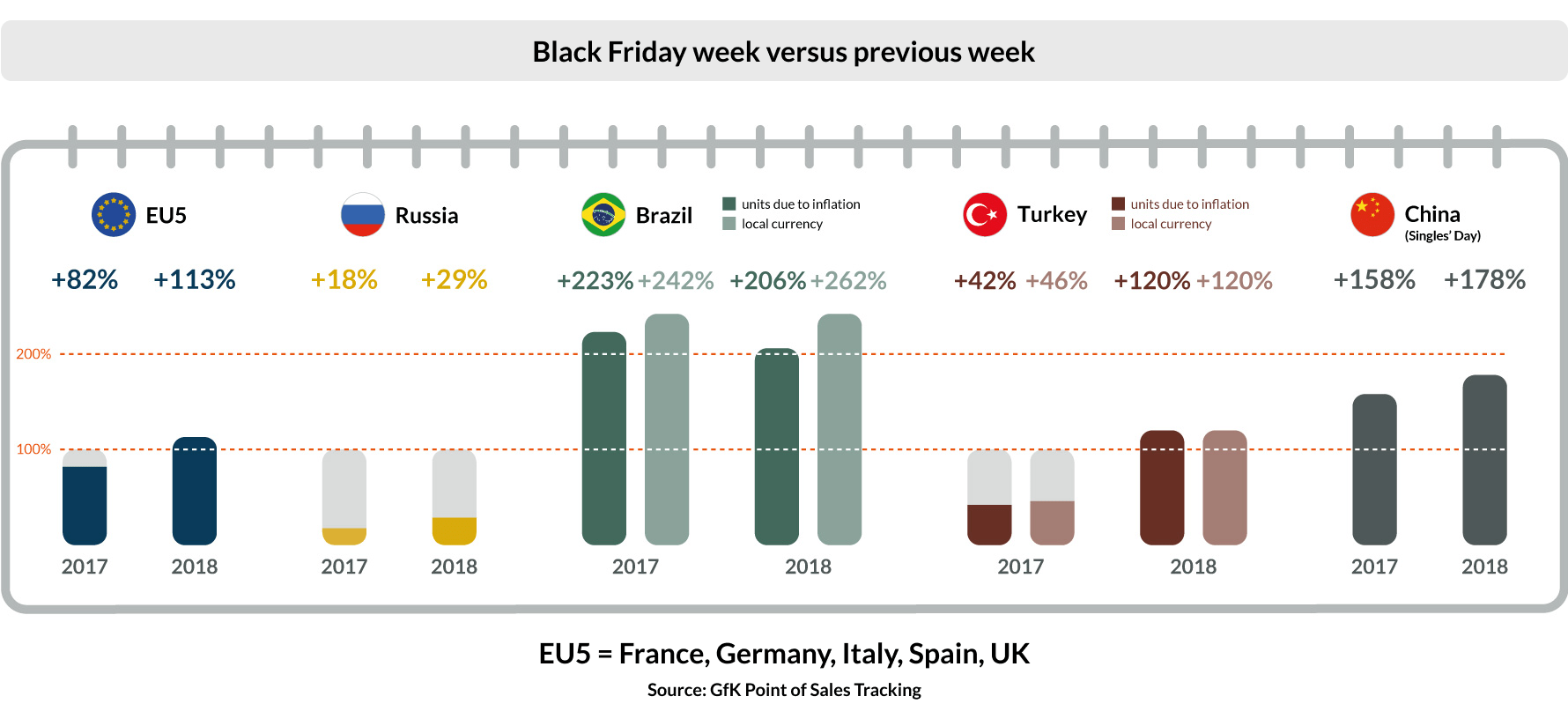

In both volume and value, Black Friday has become bigger than the traditional peak trading periods including Christmas, the January sales and Russia’s Gender holidays. In China, Singles’ Day creates double the turnover of the next best-selling week, and three times the revenues of an average week.

This year, Black Friday could well be a whopper thanks to the timing of the event. It falls on the latest possible date, 29th November – aligning it with pay days and positioning it only three weeks before Christmas. As a result, many consumers will have money to spend on Black Friday bargains, and some of those perhaps for the first time. This will be especially important in countries like Brazil, where over the last few years Black Friday shoppers have had to organize loans before making their purchases.

But savvy consumers don’t jump at just any offer.

Across the globe, shoppers are focused on value for money and are prepared to look for it.

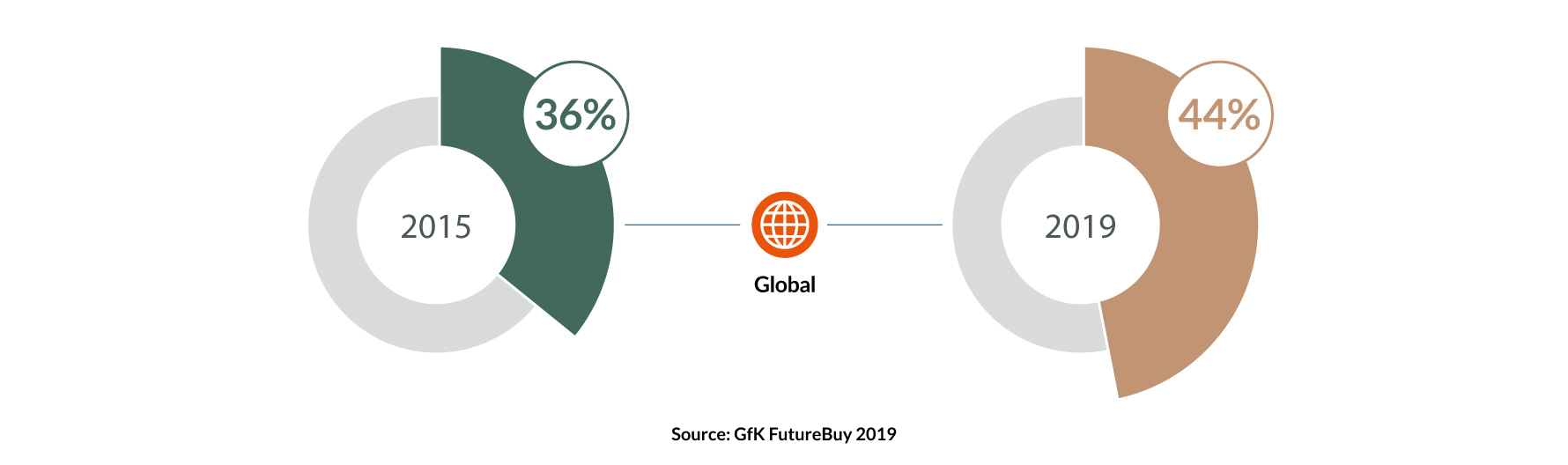

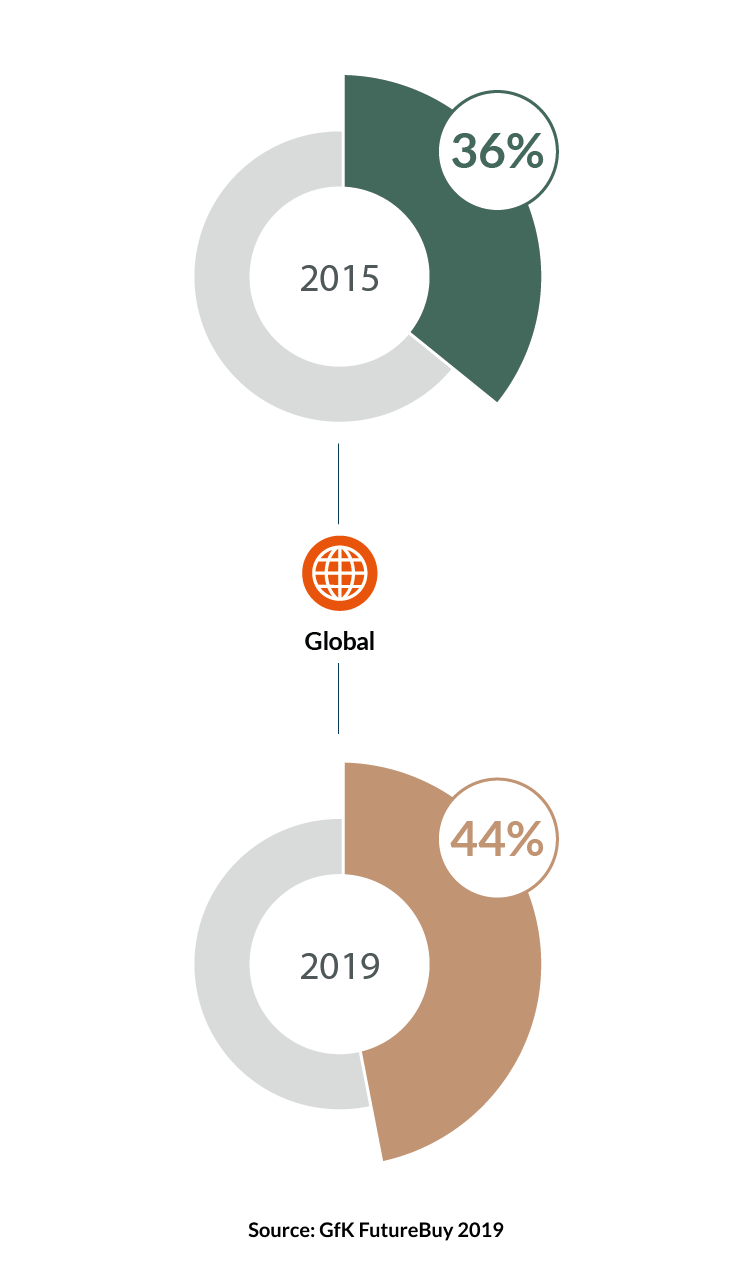

Our research shows that with the ease of making price comparisons online, a growing number of consumers shop around before taking a purchase decision. Globally, nearly half of all consumers have increased the frequency that they compare prices from different stores.

In Europe, 45% of consumers say they compare prices from different stores more often than a year ago. This rises to higher levels in emerging economies like Latin America/Turkey (both 58%) and Indonesia (56%) where consumer budgets are tight.

Given the media focus every Black Friday on how genuine some promotional deals really are, we expect that this price comparison trend will increase as more consumers research and check deals this November. So how are manufacturers and retailers dealing with the challenge of meeting consumers’ demands for bigger and better bargains, yet still ensure the event is profitable for them?

Black Friday and Singles’ Day started with the perception of ‘bargain basement’ events, with manufacturers and retailers in some cases risking their profit margins to offer sweeping discounts. The pain of this intensified thanks to these events falling in the final, ‘golden quarter’ of the year, when businesses push to meet their year-end figures, and historically rely on high levels of profitable consumer spending to do so.

As November promotions grew in terms of sales volume and value, it became evident that this early approach was not viable. In markets where Black Friday rivals, or has overtaken, Christmas spending, manufacturers and retailers are unable to sustain discounts across their range and still deliver a profitable ‘golden quarter’. As a result, they began curating their offers more strategically, which meant a change in approach in many Black Friday markets. This was particularly the case in early-adopter countries like the UK. In 2018 for instance, there were fewer items on offer, and many promotions were aimed at encouraging consumers to ‘trade up’ to buy a higher specification or more aspirational model that they may have purchased otherwise.

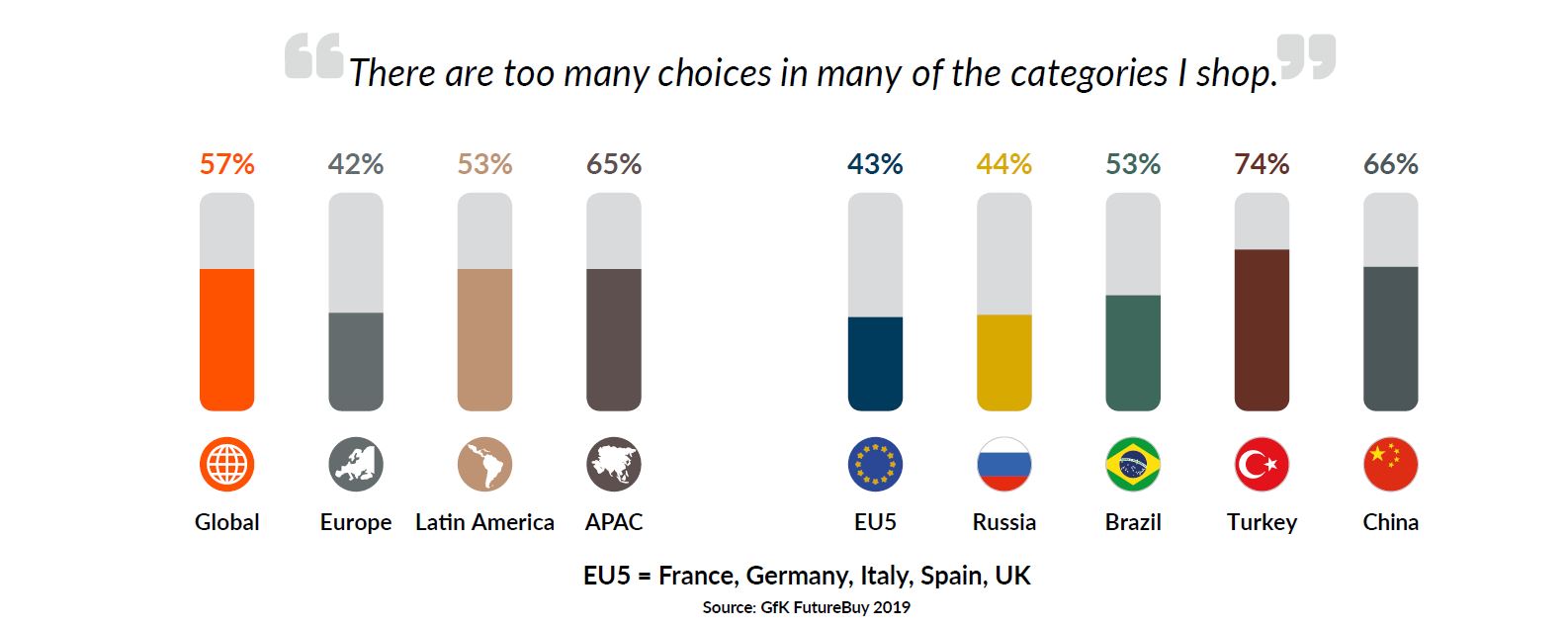

This approach however isn’t only a profit-driven strategy. A major challenge of Black Friday for shoppers is the bewildering array of offers. By focusing offers on a smaller number of products, manufacturers and retailers are trying to reduce some of that confusion and noise, thereby helping consumers to navigate a crowded shopping environment.

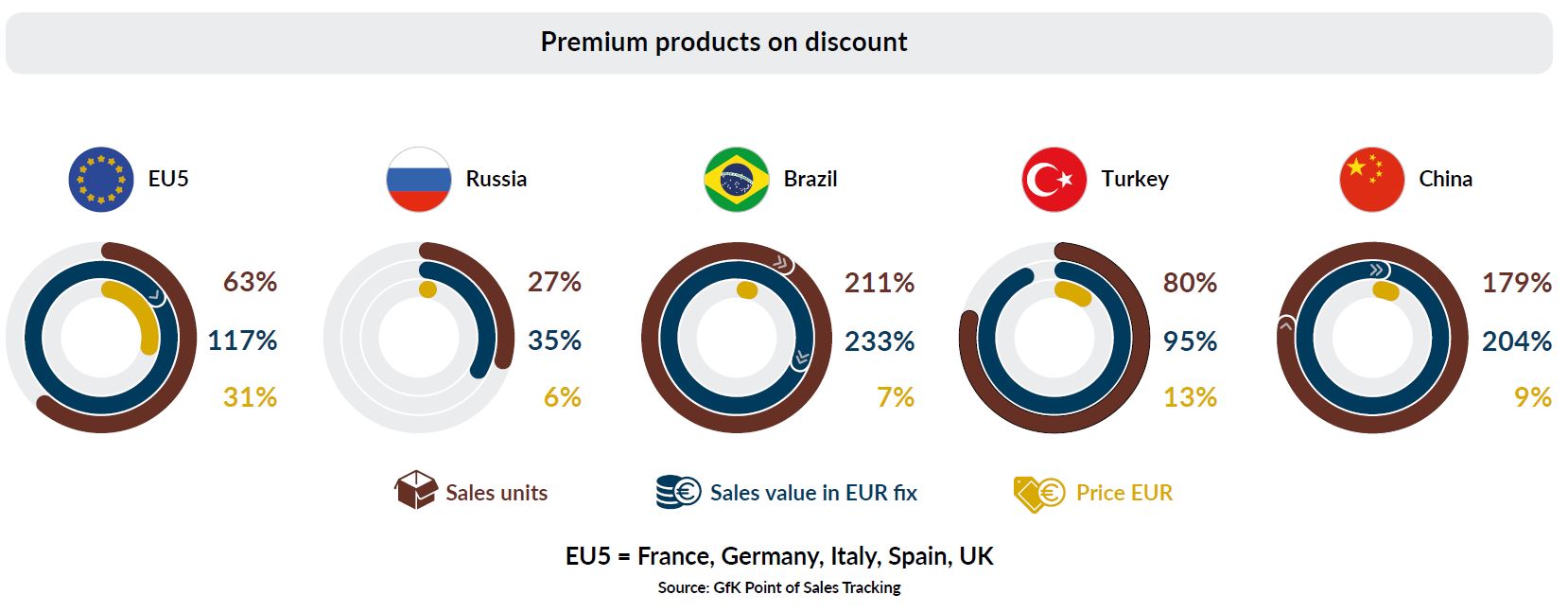

Our insights show how this strategy of premiumization for

Black Friday and Singles’ Day offers is working across many categories.

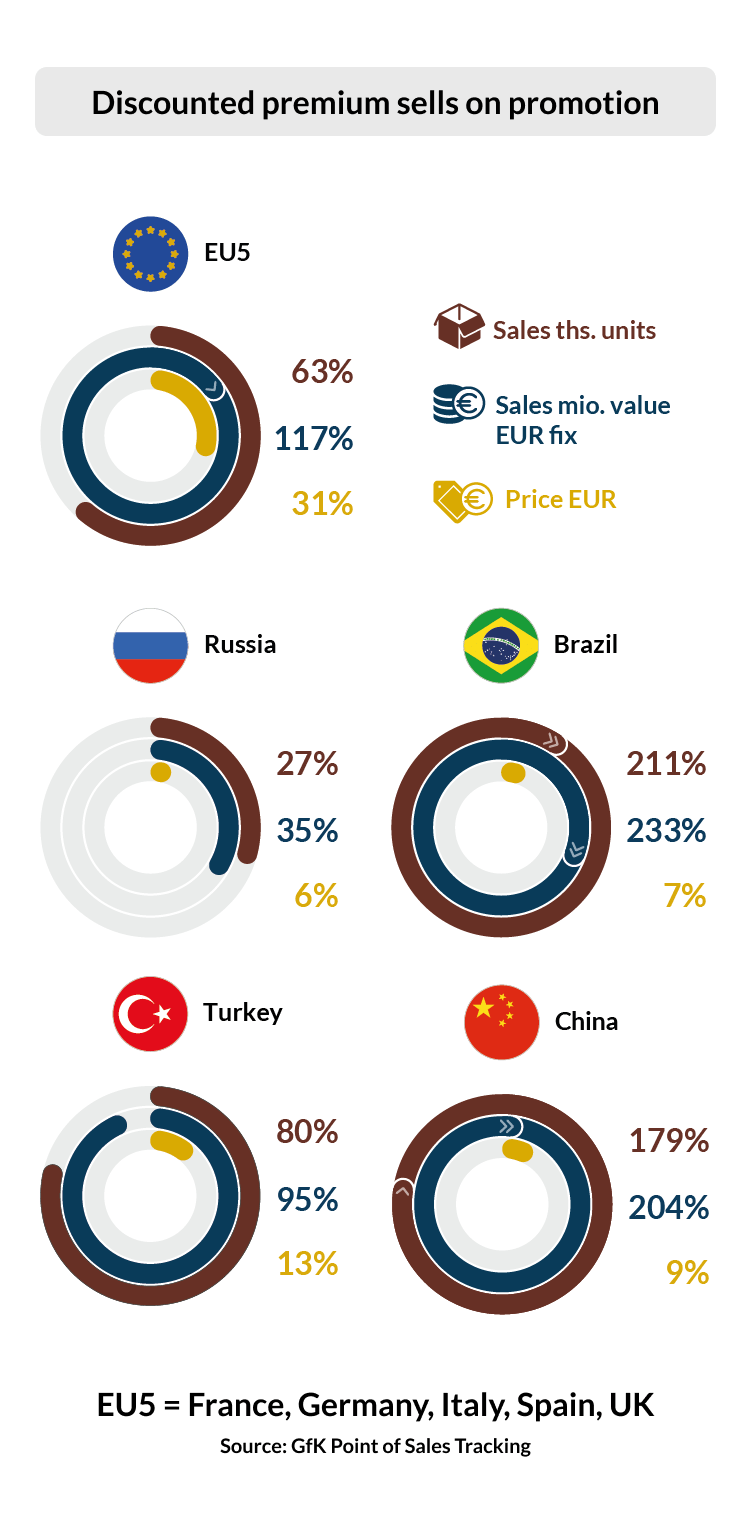

In 2018, average selling price increases were evident across Europe, with sale value growth outstripping volume. Put simply, consumers bought more premium products during promotion weeks than compared to an average week. This was particularly the case in affluent countries. Even in China, the premium effect impacted performance on Singles’ Day, and in Russia and Brazil the price increase for Black Friday outstripped inflation.

Growth Black Friday week 2018 vs. average week

Click on the flag to see the country analysis:

We’ve seen that the move towards a more premium offer was prevalent in many markets during last year’s Black Friday. The big question is how important this trend will be in the future? How well does this strategy cater to consumer needs? Do people approach seasonal promotions with a fixed shopping list, or are they open to the feel-good factor of upgrading their intended purchase, and indulging in impulse buying when they see a deal?

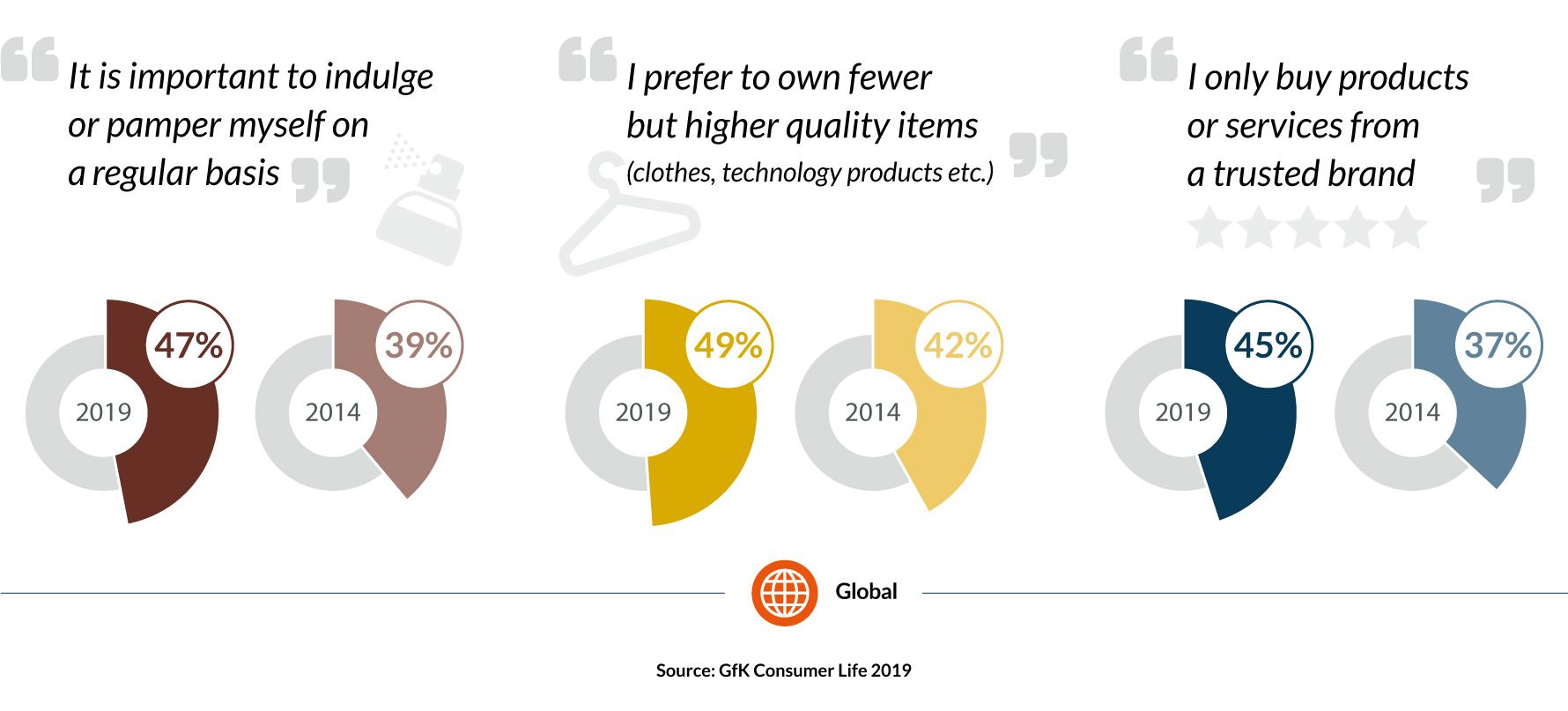

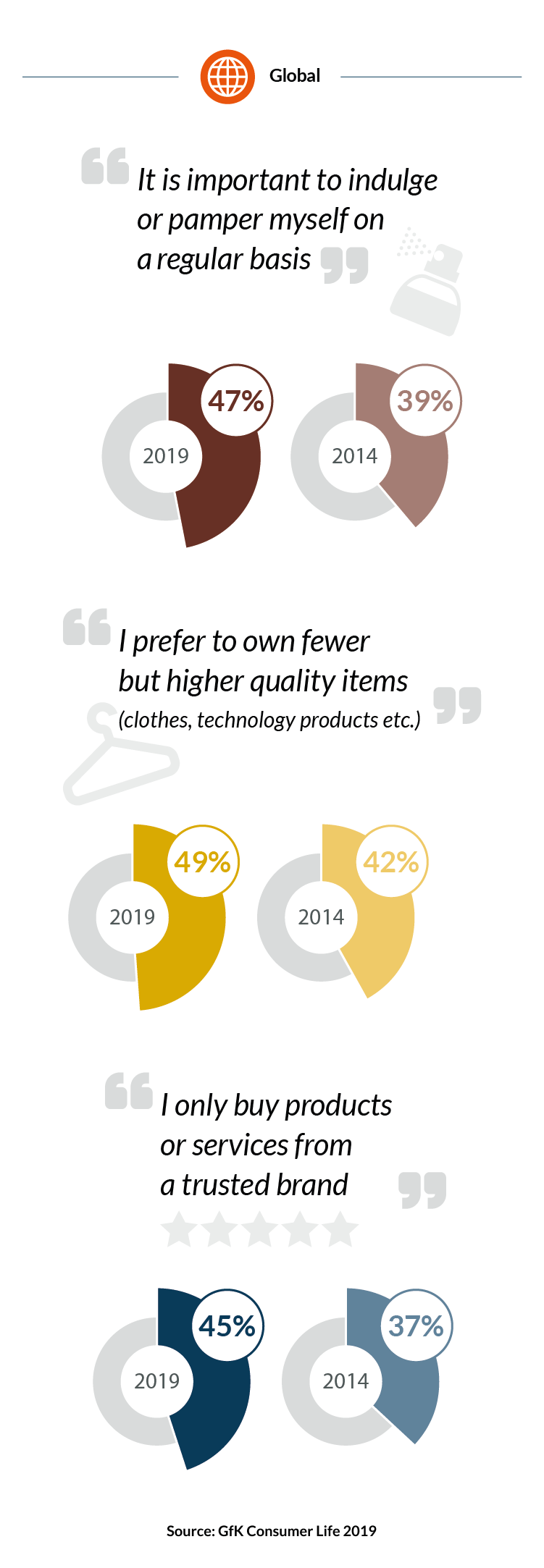

Without question, consumers across the globe love a bargain. Added to this, a significant proportion of shoppers say it’s “important to indulge or pamper myself on a regular basis” or that they “prefer to own fewer, but higher quality items” or they “only buy from trusted brands”. Combine these, and you’re on ideal ground to attract consumers who are ready to be tempted to use the promotions such as Black Friday and Singles’ Day to indulge in higher-end products.

We believe that premiumization as a retail strategy is working

and has great potential to continue to work – but there are hurdles to overcome.

Stirred up by media stories around the validity of seasonal promotion deals, consumers are becoming more skeptical to sales, discounts and promotions than in previous years. However, with the pressure to buy gifts and the observed increase in consumers wanting rapid gratification, this is unlikely to prevent significant numbers of people taking up some of the deals on offer.

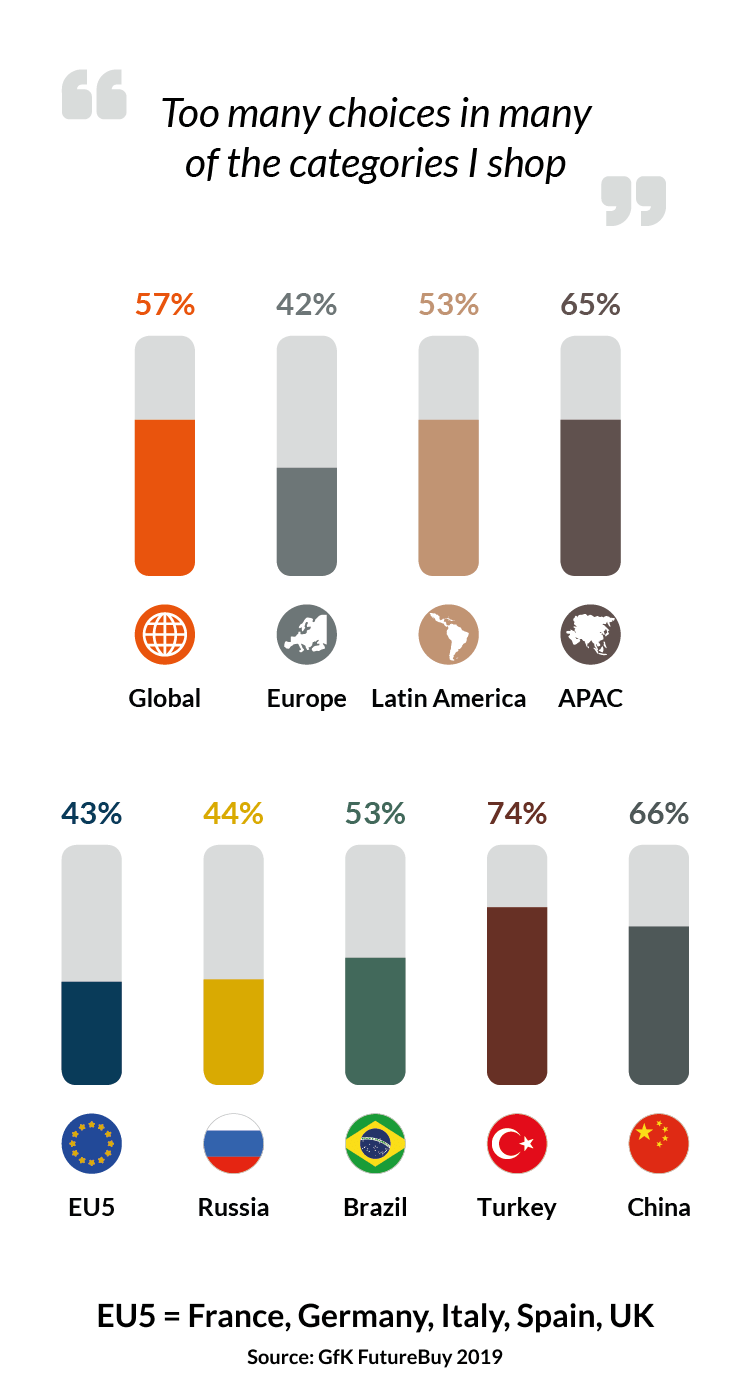

More important is the sheer overwhelming amount of “noise” consumers are bombarded with in the build up to, and during, Black Friday. With retailers and manufacturers offering different deals during the three-day event, it becomes almost impossible for consumers to robustly search the full selection and know they are getting the best offer.

Black Friday, Singles’ Day are now part of the annual retail calendar. Their success indicates that consumers do respond positively to them, and are hungry for a deal.

Here are our success factors for this year’s November seasonal promotions*:

During the promotional weeks retailers and manufacturers need to monitor sales figures closely and respond rapidly with the right tactics and strategy for their segments, categories and brands. The future success of Black Friday will increasingly depend on delivering reassurance and clarity to consumers. It’s important that shoppers are assured that price drops are genuine and see Black Friday and other seasonal price drops as offering a real benefit to them. This can be achieved through clear communication and consistent messaging.

Reducing complexity is the consumer’s mantra. Too many choices prevent decision-making. Instead, we recommend that retailers promote a few hero products that serve the consumer’s need for performance and simplification. Our weekly GfK POS tracking helps you understand which products gain the most attention/traction near key promotional events, and focus promotions on those.

Our research shows that an even more premium model mix can be sold on promotion. This is good news for revenues and ultimately margins. Promoting one or two levels above the current standard segment at an attractive price is in line with consumer demand and aspirations and is sure to attract both interest and traffic. Combine this with trust around pricing and promotional management, and it’s a winning formula. You can rely on our weekly POS tracking to monitor pricing dynamics and take corrective action fast.

(*click on the icon to read more)

Norbert Herzog

Senior Strategic Insights Manager

T +49 911 395 4534

Norbert.Herzog@gfk.com

The thinking in this article is based on our combined Consumer Insights data (Consumer Life and FutureBuy) and Point of Sales Tracking.

Share the article:

Russia

In Russia, Black Friday performance last year was driven by promotions on premium technically equipped products. The five product categories driving the highest growth during Black Friday week (compared to the week before), included TV, loudspeakers, hot beverage makers, video game consoles, and wearable technology.

As an example, large screen TVs (55”+) had sales value growth of 94%, while UHD TVs demonstrated growth of 98% (Black Friday week versus the week before), compared to the 66% overall growth of TVs, and driving the premium prices classes. The growth of premium was significant in other categories as well. For example, the higher priced segment of 30K+ Rubles for wearables demonstrated growth of 269% in value, compared to 49% growth across the total category.

Significantly, in Russia consumers prefer to buy several products in one place – which resulted in a lower growth in online sales (+27%) compared to offline (+30%) during Black Friday week last year.

Brazil

Value sales in Black Friday week were a strong 230% higher than an average week in 2018. When compared year-on-year, the solid +17% growth underlines how Brazilians love a bargain, and that Black Friday is relevant for both retailers and consumers.

Premium categories such as TVs and notebooks generated four times the previous week’s revenues. Hot air fryers were another growth category. Price promotions with discounts of up to -9% increased demand five-fold.

Play the game - but stay focused and communicate clearly

During the promotional weeks retailers and manufacturers need to monitor sales figures closely and respond rapidly with the right tactics and strategy for their segments, categories and brands. The future success of Black Friday will increasingly depend on delivering reassurance and clarity to consumers. It’s important that shoppers are assured that price drops are genuine and see Black Friday and other seasonal price drops as offering a real benefit to them. This can be achieved through clear communication and consistent messaging.

Play the right, but smaller assortment

Reducing complexity is the consumer’s mantra. Too many choices prevent decision-making. Instead, we recommend that retailers promote a few hero products that serve the consumer’s need for performance and simplification. Our weekly GfK POS tracking helps you understand which products gain the most attention/traction near key promotional events, and focus promotions on those.

More premium with value for money

Our research shows that an even more premium model mix can be sold on promotion. This is good news for revenues and ultimately margins. Promoting one or two levels above the current standard segment at an attractive price is in line with consumer demand and aspirations and is sure to attract both interest and traffic. Combine this with trust around pricing and promotional management, and it’s a winning formula. You can rely on our weekly POS tracking to monitor pricing dynamics and take corrective action fast.

Germany / Poland / United Kingdom

>> Please click here to visit the page for these countries <<

China

In China, Singles’ Day (11.11) had its peak in 2017 where growth rates of more than 65% were generated. In 2018, this all-time high could not be beaten, and spending levels were more or less stable. Singles’ Day remained by far the most important promotion week last year, generating more than twice the revenue of the next most important week (618 JD.com) and triple the revenues of an average week. There’s no question, the promotion is unrivalled in popularity.

The Chinese markets began to see a decline at the end of 2018 and this has continued through 2019. However, there are expectations that this will recover by the end of 2019, especially triggered by online promotions. This held true for the 618 JD.com promotion weeks in the middle of the year. We anticipate there will be strong demand for premium products on promotion in 2019.