What it means to be a Power Brand

Whoever said that you can't have it all clearly hasn't met a Power Brand. Power Brands are strong performers that are able to balance a brand premium, while still maintaining broad market appeal. Think of the likes of Peugeot in the auto industry in France, Persil in detergents in Germany, or Samsung for TVs in Italy.

Power brands account for just 10% of all brands globally but generate 30-40% of the revenue.

For these brands to remain at the top of their game, their strategies must combine ways to drive premium prices with sales volume. This is a balancing act. One that goes far beyond the products and services that a brand offers. It requires precise targeting, messaging, and an articulation of brand purpose, values, quality, and uniqueness.

Read on for an overview of how Power Brands can develop a strategy that sells (and one that people will get excited to pay more for!).

For more insights to help define your path to growth and find the right ways to build brand strength, watch our on demand webinar.

A Power Brand's winning strategy

Here is how a Power Brand should approach its Brand Premium and Brand Choice strategies to ensure that it maintains or improves its overall Brand Strength. By following this strategic advice, Power Brands could increase their likelihood of remaining a top performer in the market, keeping in mind that each market and each category operate differently.

-

Power Brands know the importance of driving premium pricing, so they make this a lynchpin of their strategies. To do this, they must consider the following:

1. Building Brand Attachment is a must. This helps consumers to identify with the brand, which ultimately drives loyalty and allows these brands to charge premium pricing. In the power segment, this means allowing consumers to use your brand as a status symbol or representation of who they are, who they aspire to be, and how they want to project themselves on the world.

2. Excellence and superior quality are a must. Their brand must surprise and delight its customers at every turn.

3. They need their products and services to offer something unique to justify a premium.

4. Endorsements are not just a nice-to-have. They are a necessity, thanks to social media and its power of purchase.

-

Power Brands must also drive sales volume to maintain their top status. To do this, they need to consider the following:

1. Just as with driving a premium, Brand Attachment remains key. However, for driving volume, the reasons are different - here, brands want to focus on providing consumers with joy and connection rather than projecting a certain image on others.

2. Meeting the core needs of consumers is a fundamental requirement. Before any frills, consumers want to know that their basic needs are met, which can be a balancing act for brands that are also pushing premium pricing. Some of these brands may consider a tiered pricing model.

3. Trust matters. Consumers have to feel good about the brand. To gain consumer trust, these brands must offer reliable and consistent products, as well as relatable values.

Insights from GfK Brand Architect

These rich brand insights come from GfK's brand framework, GfK Brand Architect. It takes a radically new approach to brand measurement by combining data with leading-edge analytics to measure the seven keys to brand strength and how they influence consumers decisions.

Learn more about the changes in the marketing landscape and explore what brands need to know to maximize their potential. Watch a webinar about how you can improve your brand intelligence and contribute to your business success

Topics to be covered include:

- The role brands play in driving value for their businesses

- Defining the four key brand segments and how brands can navigate these

- What drives brand strength, and how the drivers for Brand Choice differ from those for Brand Premium

- How GfK can provide personalized guidance to help brands achieve the best results

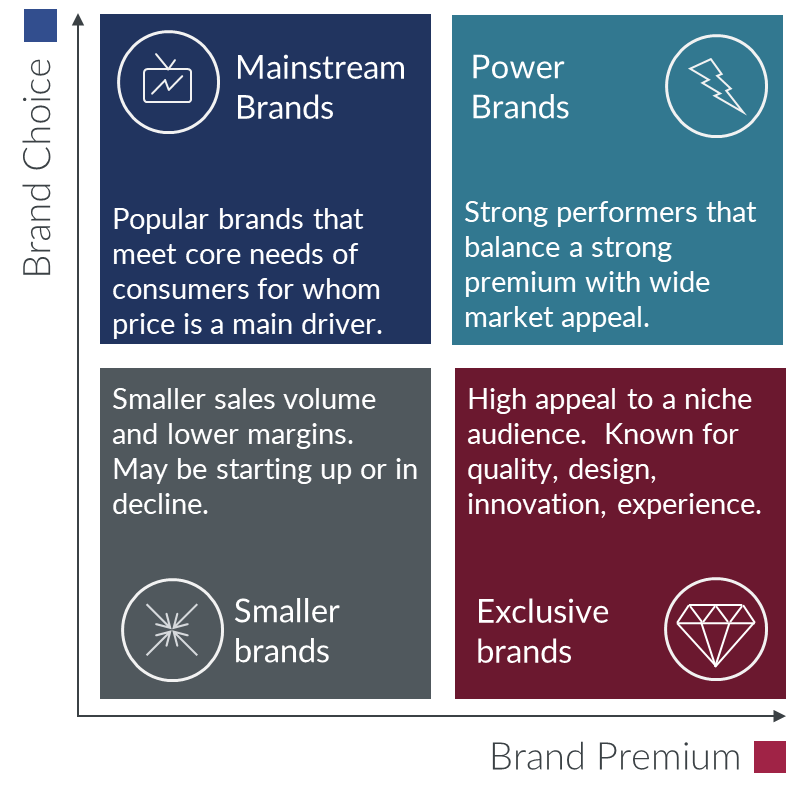

Each brand category is unique

Not all brands are power brands - some focus on luxury segments, others focus on the mainstream market, and still others focus on a very niche audience. Each of these segments has a different strategy to reach its audience. Curious to discover more about each of these segments? Read more below:

Exclusive Brands

These brands have high appeal to a niche audience and are known for quality, design, innovation, and experience.

Mainstream Brands

These brands are popular with most because they meet the core needs of consumers who are most concerned about price.

Smaller Brands

These brands are looking to have a smaller sales volume and lower margins - either just starting up or in decline.