Author: Lenneke Schils

Following the shocks and shifts resulting from the COVID-19 pandemic, markets and macro trends in shopping behavior were expected to stabilize in 2022. But the war in the Ukraine has again boosted uncertainty and instability. Worldwide inflation is jumping to peaks unknown for decades. This is especially true for food and energy prices with an obviously strong impact on household budgets.

How do shoppers react to often drastic budget squeezes –

and how can manufacturers and retailers best master these new realities?

The direction, speed and depth of these assimilations depend on a number of factors, which also differ in the dimension that shoppers are being affected. Analyzing these external factors helps to better understand and predict shoppers’ coping strategies.

Where you live – unsurprisingly, where people live has a major impact on budget concerns and a potential budget squeeze. As inflation rates differ considerably by region, budget is a major concern for 57% of consumers in Central and Eastern Europe, and only for 35% in Western Europe. Whereas 33% of Swedish shoppers declare to take more control of their household spend, it is a top priority for 53% of Italians.

Food inflation – though we have seen similar inflation rates for food and beverages in the past, especially around 2008, total inflation rates were lower then. Today, consumer wallets are additionally pressurized by other aspects, primarily household electricity: While food prices in the EU rose by +8.6% on average in May, energy and housing rose by 16.3% (1). As people need to spend more on energy, they have to adjust their wallet shares on the expense of other components, including food.

Price versus quality orientation – With the exception of German shoppers, who slightly prioritize quality over price, shoppers in all other EU countries are more price-sensitive – and will pay less for food and beverages. For example, price-oriented consumers 'normally' already pay on average 10% less for beverages and their share of private labels is higher than with quality shoppers.

But now we are noticing a clear behavior change for both more price- and more quality-oriented countries: Collective trading-down already started early in the year, with people shifting to other options, be it cheaper brands, private labels or cheaper retailers. For the first five months of 2022, Belgium, for example, reported a value loss of -1.7% only due to down-trading, with leader, premium brands and challengers losing share. Economic brands remained stable, but could not profit from the value-for-money perception, whereas private labels did. In the Netherlands, where an average large shopping basket is +16% more expensive today, private label shares reach higher levels than before the pandemic.

However, FMCG tends to benefit in volume in difficult times, because out-of-home consumption is sacrificed. Working from home continues this year, albeit at much lower levels than during lockdown periods, which is also pushing FMCG volumes beyond 2019 levels.

(1) Source: https://www.ecb.europa.eu/stats/macroeconomic_and_sectoral/hicp/html/index.en.html

Three crisis types and their budget strategies

Not all households act alike and adding to the external denominators described above, the private, financial situation of households including expectations about its stability are probably the most differentiating factors for shopping behavior in the current situation.

Across Europe more than 1 in 3 households (37%) is struggling to make ends meet. In countries such as Italy, Croatia and Serbia this counts for around half of the population. On average, 15% of EU-people are afraid of losing their job, especially in Eastern and Southern European countries, and as many as 28% of Bulgarian citizens fear their job at risk.

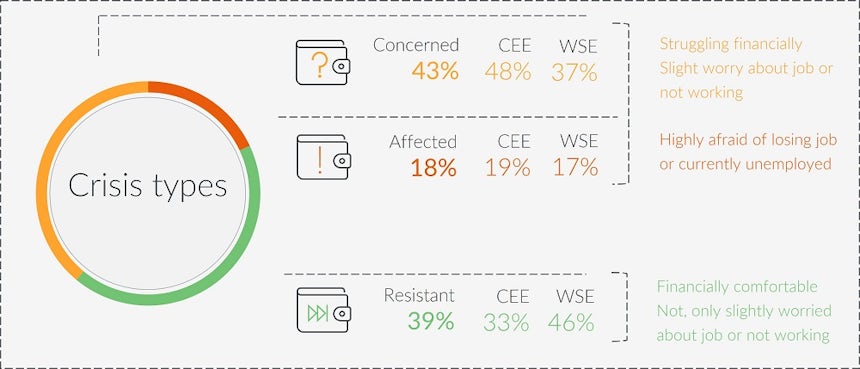

We have condensed these fundamental household dynamics into three crisis types and representative budget concerns. Across Europe,

43% of shoppers are “concerned”, struggling financially,

slightly worrying about their job or not working,

18% are “affected”, being highly afraid to lose their job

or currently unemployed

39% of “resistant” shoppers are in a financially comfortable situation

with no or only slight worries about their job, or no longer working

2 in 3 affected or concerned in Central and Eastern Europe

Conscious purchasing and consumption of food

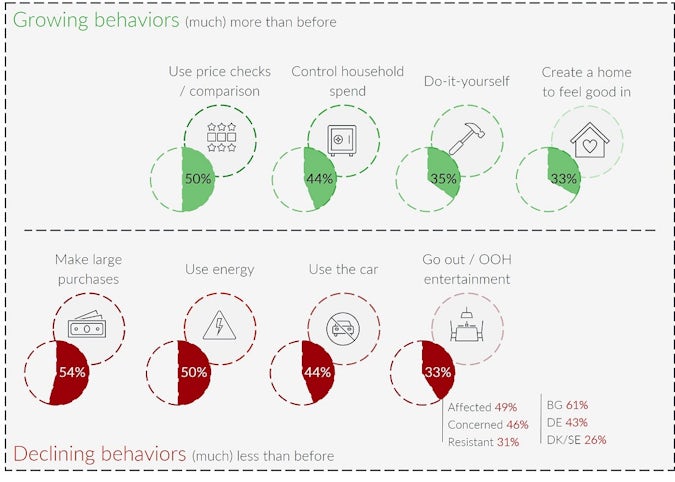

While COVID-19 has somehow become a part of our daily lives, the geopolitical crisis and the resulting inflation have now resurrected consumers’ worries – their sentiment has dimmed, they are once again retreating to their secure home environment. Large purchases have been put on hold, households are restricting their energy usage, also using their car to a lesser extent. Shoppers’ will resort to multiple strategies to keep household spending in check.

Consumers are changing their behavior – adopting a new frugality

Though FMCG sales are still estimated to be higher than pre-COVID, shoppers will shift budgets to cope with high inflation rates, either changing product or brand categories within their preferred channel, or switch retailers. Groceries are very top of mind, when it comes to worrying about price increases: over half of European shoppers are concerned and plan to change their buying behavior accordingly. The dynamics vary per category: from cutting meat altogether to up-trading in instant coffee.

“Which strategy changes will shoppers adopt when it comes to everyday goods?” was one of our questions for shoppers and FMCG businesses. Both agree on the top three behavior changes, which are: check prices (much) more, search or wait for promotions, and keep the total amount of the shopping basket low. However, whereas businesses expect shoppers to switch to a cheaper retailer (82%) or from a premium to a cheaper brand (72%), shoppers first want to make better use of their food, waste less and cook more at home, before they switch to cheaper a brand or a cheaper retailer (both at 37%).

Shoppers and business not always in agreement on expected behavior change

Down-trade or discontinue

More conscious purchasing including the search for lower prices and promotions will inevitably lead to categories dropping out of the basket – especially when subject to high impulse purchasing and low promotion. The specific categories highly in danger of losing out are those perceived as a luxury, especially alcoholic beverages, confectionery, and cosmetics.

Whereas the concerned will first focus on crossing perceived luxuries as well as meat off their list, the affected will need to cut down on general “daily” food, intending to save on fresh and staple foods, (non-alcoholic) drinks and home care.

The particular coping strategy depends very much on the individual product category, ranging from buying less (e. g. confectionary) or even discontinue to buy (frozen foods/meals) to down-trading or waiting for promotions (home care). Stockpiling or switching retailers are less prominent options for shoppers.

Shoppers worried about price increases will adopt different coping strategies per category

Price is not everything

With inflation rising, price is a growing driver of behavior changes, even among crisis resistant buyers. But it does not automatically overrule everything else. Asked about the criteria that are becoming more influential for their household decisions, shoppers first stress the importance of healthy ingredients, natural ingredients, and local, regional products.

Shoppers will not sacrifice everything for the sake of price nor relinquish their principles, but rather employ different strategies for different products including down-trading, waiting for promotions or switching to a discounter. A closer look at the top five choice drivers for both Western and Eastern Europe shows, that shoppers rate healthy ingredients by far as the most important criterion, expecting first and foremost no artificial additives, low sugar and no genetically modified ingredients.

Naturally healthy is clearly a crisis-resistant choice driver and while businesses feel that they are on top of aspects such as safety and natural ingredients, shoppers do not seem to be too convinced – definitely an opportunity for FMCG to re-evaluate, invest in and promote.

Strategies for FMCG to cope with new realities

The critical situation in supply chains and supplies of energy, raw materials, and other pre-products will last throughout 2022. Especially food and energy prices will continue to rise and put household budgets under further pressure. Yet, if done right, even these difficult market conditions offer opportunities for FCMG, which GfK has condensed into five coping strategies.

- Offer value for money – To offer (perceived) value for money is imperative to counter the risk of shoppers’ down-trading or dropping out of product categories completely. This is especially true for products often subject to impulse purchases.

With budgets under pressure, price

has moved into the focus of shoppers

- 56% will check prices (even) more

- 49% will wait for promotions (even) more

- 45% will lower their total basket value

This budgeteering behavior does not imply that fulfilling lifestyle needs is becoming less important. But shoppers increasingly opt for premium private labels, as they fill the added-value-for-money gap. For all four macro trends, which GfK is following – convenience, sustainability, health and premiumization –, we see premium private labels representing an alternative for sophisticated shopper needs in times of inflation.

Hence, brand investment is more important than ever. Being listed broadly, including at discounters, having a fair share of true innovations on the shelves, and being top of mind already pre-store is indispensable. - Focus on key trends – “Naturally healthy” is the key trend, which proves to be resistant across all crisis groups. Shoppers are willing to pay higher prices if it serves a healthier lifestyle – provided it fits their budget. Investing in products and categories that support preventative health, and nudging, especially the affected, to follow a balanced and natural diet, will help retain consumers.

The second trend – “glamorously green” – is primarily driven by eco-actives, who seek to strike a balance between affordability and their green attitude. While sustainability remains an important topic for a large group of shoppers, affordability increasingly constitutes an obstacle to buying right. This could provide a great opportunity to approach sustainability from a savings perspective, supporting consumers in their effort to reduce food and energy waste.

Keeping the green trend going and “helping” eco-minded shoppers, requires for manufacturers and retailers to make it attainable, focusing on affordability - value for money –, but also in-store findability. - Build strong brand identities – Today’s cost-of-living crisis sets the scene for private labels and hard discount returning to growth, and we are seeing plenty of evidence for that. Manufacturer brands are under pressure, not only from private labels but also from newcomers, who better address factors that drive brand choice today: besides functionality, this encompasses a credible balance of emotionalization and responsibility. Aspects including natural, waste reduction and local represent resistant influencing factors.

Brands need to be aggressive to defend their position. During downturns, investments in brand salience and availability are typically cut, but this proves to be quite detrimental and often irreparable in the long run.

Winning brands: what we know

- Winning brands grew their product range with 40% via additions, not substitutions

- Winning brands gained twice as many listings at discounters

- In categories where shoppers have a very positive image about the level of brand investment, innovation, brand trust and value for money, private label shares are up to 25% lower

- Brands, which increased their advertising share in times of contraction, gained 12% more market share than those that did in times of market expansion (and this number even rises to +19% for R&D expenditures)

The challenge is to build the right brand strategy and product portfolio to address the needs and expectations of different shopper groups. - Work to meet shopper expectations – Customer satisfaction in stationary retail still outpaces any form of e-supermarket and quick commerce. Omnichannel is key: Maintain a high level of in-store excellence and be sure to apply this with equal rigor to online. Providing a sense of good (added) value on total basket size and rewarding customer loyalty is of increasing importance in the coming period.

- Re-think shopper segmentation in light of new realities – Confronted with new and changing realities, shoppers will potentially revise their spending strategy and adjust their shopping behavior. This requires granular analytics to constantly evaluate shopper segmentation and shopping personas to detect behavior changes and dynamically adjust product positioning, promotions and merchandising.

Manufacturers and retailers alike have to make sure their promotions are as effective as ever, or they risk losing buyers. Single price-offs might be more functional at this stage than multi-buys to keep penetration levels up.

In times of crises – climate change, COVID-19, war in the Ukraine, and inflation –, shoppers will be creative to meet their needs. For brand manufacturers and retailers this represents potential and risk at the same time: It is imperative to adapt their strategies to the needs of shoppers.

Final note: In addition to GfK’s established consumer panels, we conducted a bespoke survey in April, covering fifteen countries and nearly 8,000 shoppers, and asked businesses – 260 manufacturers and retailers across the European region – to share their views.

Want to have further insights into coping strategies

in times of inflation?

FAQs

-

Which factors impact shoppers’ behavior in times of inflation?The direction, speed and depth of behavior changes depend on a number of factors, which also differ in the dimension that shoppers are being affected. External factors include location – i. e. where shoppers live – their lifestyle and price-orientation as well as the dimension of food inflation. The other key factor is the private, financial situation of households including expectations about its stability. At GfK, we condensed the fundamental household dynamics into three crisis types and representative budget concerns. Across Europe, 43% of shoppers are “concerned”, struggling financially, slightly worrying about their job or not working, 18% are “affected”, highly afraid to lose their job or unemployed, and 39% of “resistant” shoppers are in a financially comfortable situation with no or only slight worries about their job, or no longer working.

-

How do consumers cope with food inflation?Shoppers will shift budgets to cope with high inflation rates, either changing product or brand categories within their preferred channel, or switch retailers. More conscious purchasing will inevitably lead to categories dropping out of the basket, especially those perceived as a luxury, including alcoholic beverages, confectionery, cosmetics, and meat. The particular coping strategy depends very much on the individual product category, ranging from buying less or discontinue to buy, to down-trading or waiting for promotions. Stockpiling or switching retailers are less prominent options for shoppers.

-

Is price the only choice driver?Price is a growing, but not the only driver of behavior changes. The criteria that are becoming more influential for household decisions also include healthy ingredients, natural ingredients, and local, regional products. Nonetheless, with budgets under pressure, price is moving into the focus of shoppers: 56% will check prices (even) more, 49% will wait for promotions (even) more, and 45% will lower their total basket value.

-

What is FMCG?FMCG stands for fast-moving consumer goods, and applies to relatively low-cost, non-durable goods such as food and medication. These goods have a high inventory turnover, and are often found in supermarkets, pharmacies, and convenience stores.